Building a cloud marketplace from scratch drains resources, delays market entry, and risks missing revenue opportunities while competitors move ahead. For cloud solution providers, telcos, MSPs, and ISVs, time to market determines who captures customer relationships first.

Worldwide public cloud spending is forecast to reach $723 billion in 2025 (Gartner), yet 42% of companies experience revenue leakage (MGI Research) through manual billing processes and disconnected systems. The gap between market opportunity and operational execution has never been wider.

Organizations building custom platforms invest 6 to 12 months in development while watching their addressable market shrink. White label cloud marketplace platforms collapse this timeline to 2 to 8 weeks, letting businesses capture revenue from day one instead of hemorrhaging budget on development cycles.

If you’re a CSP managing multi-tier partner hierarchies, a telco executing cloud transformation, an MSP scaling subscription services, or an ISV distributing across cloud providers, your marketplace infrastructure determines whether you scale or stall.

The right white label cloud services platform becomes your revenue engine, not your technical burden.

Key Takeaways

- Organizations using white label cloud marketplace platforms reduce deployment from 6-12 months to 2-8 weeks, accelerating revenue capture and market entry without custom development overhead.

- Pre-built infrastructure eliminates 60-70% of costs compared to building from scratch while providing instant access to tested billing, provisioning, and partner management capabilities.

- Multi-cloud catalog integration allows immediate distribution across Azure, AWS, and Google Cloud with automated provisioning that activates services in minutes instead of days.

- Automated billing and commission calculation handle complex multi-tier partnerships, usage-based pricing, and revenue recognition without manual reconciliation or spreadsheet errors.

- Branded storefronts maintain your market identity while backend automation manages subscription lifecycles, renewals, and customer self-service across global markets. Revenue leakage drops to near-zero through real-time usage tracking and automated invoice generation that captures every consumption event without human intervention.

Why Cloud Businesses Choose White Label Marketplace Infrastructure?

Custom platform development sounds appealing until you calculate the actual cost. Building a marketplace from scratch typically requires $40,000 to $500,000 in development investment, 6 to 12 months of engineering time, and ongoing maintenance that diverts resources from core business growth.

Organizations betting on custom builds often discover hidden costs in integration testing, security compliance, payment gateway certifications, and OSS/BSS connectivity that double initial estimates.

White label cloud marketplace platforms flip this equation. Pre-built infrastructure tested across thousands of implementations means you inherit proven workflows without debugging production issues on customer transactions.

The business question isn’t whether white label platforms work, it’s whether you can afford to spend a year building what’s already available.

- Speed creates competitive moats. While competitors assemble development teams, negotiate vendor contracts, and debug API integrations, you’re onboarding partners, signing customers, and generating revenue.

- First mover advantage in cloud distribution compounds monthly through partner relationships, customer lock-in, and marketplace network effects that become nearly impossible for latecomers to overcome.

- Capital efficiency determines survival. Startups and scale-ups operating on investor capital or internal budgets can’t justify half-million-dollar platform builds when white label alternatives cost 60-70% less.

- The savings don’t just improve balance sheets, they fund customer acquisition, partner incentives, and market expansion that actually grow the business instead of building infrastructure competitors already possess.

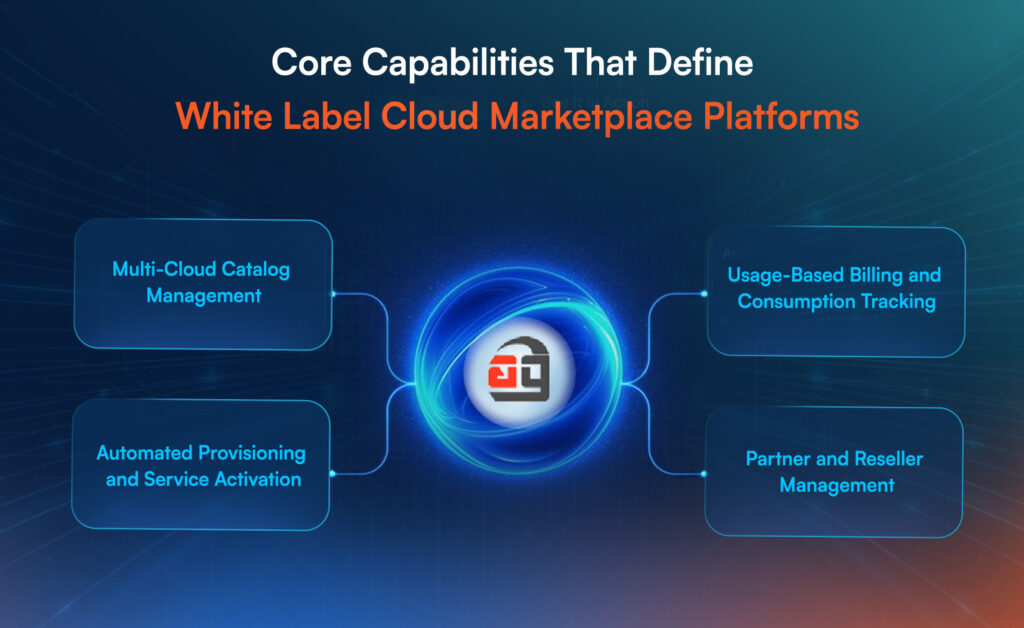

Core Capabilities That Define White Label Cloud Marketplace Platforms

Understanding what separates robust white label cloud services platforms from basic storefront templates determines whether your infrastructure scales or collapses under growth.

Not all platforms handle the complexity CSPs, telcos, MSPs, and ISVs require for serious cloud distribution.

Multi-Cloud Catalog Management

Your customers don’t buy “Azure” or “AWS,” they buy solutions to business problems. Effective white label cloud marketplace platforms present unified catalogs that combine Microsoft, Amazon, Google, and proprietary offerings into coherent bundles that customers can understand and purchase without technical expertise.

Pre-integrated catalogs eliminate weeks of SKU mapping, pricing synchronization, and product documentation that teams otherwise handle manually. When Microsoft releases NCE pricing updates or AWS adjusts consumption tiers, your platform reflects changes automatically instead of requiring emergency updates that risk billing errors.

Support for IaaS, PaaS, SaaS, and ISV applications within single transactions means customers build complete solution stacks through one checkout flow. This bundling capability increases average deal sizes while reducing the procurement friction that sends customers to simpler alternatives.

Automated Provisioning and Service Activation

Manual provisioning workflows kill cloud businesses. Every ticket requiring human intervention to activate services creates cost, introduces errors, and delays revenue recognition. Organizations processing orders manually report activation times measured in days or weeks, creating customer frustration and abandonment.

Zero-touch provisioning through API integrations with cloud providers means orders flow from purchase to activation without human handoffs. When a customer buys Azure Virtual Desktop licenses, the system immediately provisions access, assigns entitlements, and confirms activation to both customer and reseller, all within minutes.

| Manual Provisioning | Automated Provisioning |

| 3-7 days average activation | Minutes to activation |

| High error rates from data entry | Near-zero errors from automation |

| Support tickets for every order | Self-service order tracking |

| Limited after-hours processing | 24/7 order processing |

| Revenue delay until activation | Immediate revenue recognition |

Multi-cloud automation extends beyond basic SKU activation. License upgrades, service downgrades, subscription modifications, and cancellations execute immediately through the same automated workflows that handle initial provisioning, keeping your operations team focused on strategic initiatives instead of manual transaction processing.

Usage-Based Billing and Consumption Tracking

Cloud economics run on consumption. Fixed subscription pricing works for some services, but Azure consumption, AWS compute hours, and data transfer charges require real-time usage metering that captures every billable event without human oversight.

Effective white label cloud marketplace platforms ingest usage data directly from cloud provider APIs, apply your pricing markups, calculate customer charges, and generate invoices without manual intervention.

Organizations lose 1-5% of EBITA to revenue leakage (EY) when relying on manual processes, spreadsheets, and disconnected systems that fail to capture all billable usage.

- Prorated billing calculations handle mid-cycle subscription changes that confuse manual processes. When customers upgrade from 50 to 100 licenses mid-month, the system calculates prorated charges for the partial month automatically instead of requiring finance teams to build spreadsheet formulas and verify math before invoicing.

- Multi-currency support lets you serve global markets without currency conversion headaches. The platform displays prices in local currency, accepts payments in customer-preferred denominations, and consolidates revenue reporting in your base currency with automated exchange rate handling.

Partner and Reseller Management

Multi-tier distribution defines modern cloud commerce. Direct sales can’t scale to reach every market segment, geography, and vertical. Building partner ecosystems through distributors, resellers, and sub-resellers multiplies your reach without linear headcount growth.

Managing partner hierarchies manually creates commission disputes, payment delays, and trust erosion that kills partner programs. White label platforms automate commission tracking across N-tier partner structures, calculating splits at transaction time and providing real-time visibility into pending payouts that eliminate month-end reconciliation chaos.

Partner-specific pricing rules let you offer different margins to enterprise distributors, regional resellers, and niche VARs without manual quote generation. The system applies partner pricing automatically based on login credentials, customer segment, or product category, keeping pricing governance centralized while giving partners flexibility to compete in their markets.

White label storefronts for partners mean your resellers sell under their own brand while you maintain backend control. Partners customize their marketplace appearance, set customer-facing pricing within your margin guardrails, and provide support under their identity, all while your platform handles provisioning, billing, and license management invisibly.

How White Label Platforms Solve Real Cloud Business Problems

| Problem | Manual Process Cost | White Label Solution | Verified Impact |

| Manual Billing Errors | 88% of spreadsheets contain errors (Ray Panko, University of Hawaii). Manual data entry causes missed renewals, incorrect charges, and unbilled usage. | Automated billing engines ingest usage data from cloud providers, apply pricing rules, and generate invoices without human intervention. | 42% of companies experience revenue leakage (MGI Research) that automation eliminates. |

| Slow Time to Market | Custom marketplace development requires 4-9 months on average (SOLTECH), with enterprise systems taking 12-24 months (2024 Industry Analysis). | White label platforms launch in 2-8 weeks depending on customization needs. | First-mover market capture while competitors spend months in development. |

| Complex Partner Structures | Manual commission calculations create reconciliation chaos, payment delays, and partner disputes consuming finance team resources. | Real-time commission calculation across partner tiers. Automated split billing with transparent dashboards for all parties. | Month-end reconciliation eliminated through transaction-time automation. |

Telco Transformation Through White Label Cloud Marketplaces

Telecommunications companies face unique pressures in modernizing legacy BSS/OSS systems while launching cloud services that compete with hyperscalers and pure-play cloud providers. Traditional telco infrastructure wasn’t built for self-service cloud consumption, creating gaps that white label cloud marketplace platforms fill.

Convergent billing remains the biggest challenge in telco cloud transformation. Customers don’t want separate bills for mobile services, internet connectivity, cloud compute, and software subscriptions. They want unified invoices that consolidate all services with clear line-item breakdowns showing usage and costs.

White label platforms designed for telcos integrate with existing BSS systems through APIs, pulling traditional telecom billing data while adding cloud marketplace transactions into unified invoices.

This convergent approach lets telcos bundle connectivity with cloud services, positioning them as complete digital solution providers instead of dumb pipes competing solely on bandwidth pricing.

Partner ecosystem enablement helps telcos extend reach beyond direct sales. Regional system integrators, managed service providers, and vertical-specific solution providers all need access to telco cloud offerings to build complete customer solutions.

White label platforms provide these partners with branded storefronts, automated provisioning, and commission tracking without requiring telcos to build separate partner portals.

Telcos deploying white label cloud marketplace platforms report 3X revenue growth in year one through expanded service portfolios, 2X partner outreach through automated onboarding, and 6X solution expansion by bundling cloud services with traditional offerings.

These metrics reflect the compounding effect of removing friction from cloud service delivery while maintaining telco brand identity and customer relationships.

MSP and CSP Operational Requirements

MSPs and CSPs cannot simply integrate a cloud marketplace without proper operational requirements. The parameters are very important for their long-term scalability and ROI.

Let us see what are the core requirements for the same.

Subscription Lifecycle Automation

It addresses the margin erosion that kills MSP profitability when manual processes scale linearly with customer growth. Every 100 customers added through manual subscription management requires proportional headcount increases that destroy 5-10% margins common in managed services.

Automated platforms handle trial activation, subscription upgrades, renewal processing, and cancellation workflows without human intervention. Customers receive renewal reminders 90, 60, and 30 days before expiration with self-service links that process payments instantly.

Trial-to-paid conversion executes automatically when periods expire and customers confirm purchase, eliminating manual provisioning delays that frustrate customers and delay revenue recognition.

Financial Reporting and Reconciliation

transforms month-end chaos into continuous accuracy for MSPs reconciling Microsoft charges against customer billing. Manual reconciliation through spreadsheets comparing Microsoft invoices to customer charges consumes days and frequently reveals discrepancies requiring urgent investigation and correction.

Automated reconciliation matches your billing to Microsoft invoices in real-time, flagging discrepancies immediately instead of at month-end when correction becomes crisis management.

The platform identifies missing charges, incorrect pricing, and usage data gaps before they become revenue leakage, giving finance teams weeks to resolve issues instead of hours.

Multi-Tier Partner Management

enables CSPs to scale distribution without linear overhead growth through automated partner hierarchies that calculate commissions, track deal registration, and manage credit limits across distributor, reseller, and sub-reseller levels.

White label storefronts let partners sell under their own brand while you maintain centralized provisioning, billing, and support control.

Partner-specific pricing rules apply automatically based on login credentials, customer segment, or product category, keeping pricing governance centralized while giving partners flexibility to compete in their markets without manual quote generation or approval workflows.

Operational Efficiency Metrics

reveal the hidden costs manual processes create through delayed provisioning, billing errors, commission disputes, and support tickets that consume staff time. Organizations tracking average order-to-activation time discover manual workflows require 3-7 days versus minutes for automated provisioning.

Commission dispute resolution that occupies finance teams for days each month disappears when partners access real-time dashboards showing pending payouts and transaction details.

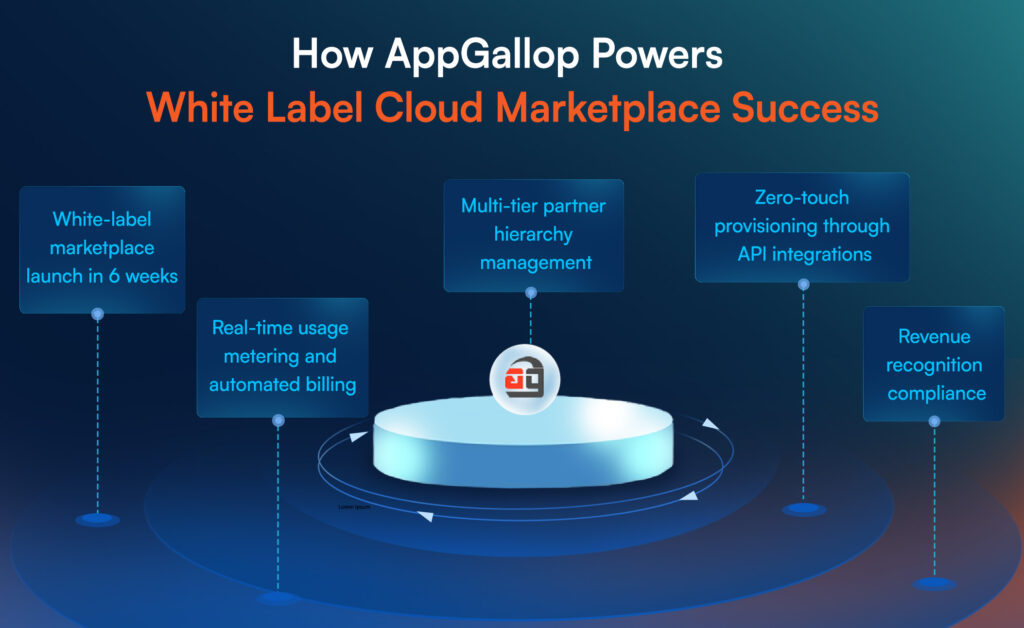

How AppGallop Powers White Label Cloud Marketplace Success

AppGallop provides the infrastructure telcos, CSPs, MSPs, and ISVs need to launch branded cloud marketplaces without custom development overhead.

AppGallop enables rapid cloud marketplace deployment that enables:

- White-label marketplace launch in 6 weeks with customizable storefronts and multi-cloud catalog integration

- Real-time usage metering and automated billing supporting prepaid, postpaid, and consumption-based pricing models

- Multi-tier partner hierarchy management with automated commission calculation and split billing across distributors, resellers, and sub-resellers

- Zero-touch provisioning through API integrations with Azure, AWS, and Google Cloud that activate services in minutes

- Revenue recognition compliance through ASC 606-automated accounting that eliminates manual revenue tracking

Tata Tele Business Services deployed AppGallop in 6 weeks, replacing multiple disconnected tools and achieving 3X revenue growth with 6X solution portfolio expansion in year one.

Want to launch your Marketplace in a Go? Reach out to us through this Demo Form!

Security, Compliance, and Trust

Cloud marketplace platforms handle sensitive customer data, payment information, and subscription records that require robust security controls meeting industry standards and regulatory requirements.

- Data encryption protects customer information both in transit and at rest through TLS protocols for network communication and AES-256 encryption for stored data. This encryption prevents unauthorized access even if attackers compromise infrastructure, ensuring customer trust remains intact through security incidents.

- Payment Card Industry (PCI) compliance becomes the platform provider’s responsibility instead of yours. White label solutions maintain PCI certification through regular audits, security assessments, and infrastructure hardening that would cost organizations $50,000-$100,000 annually if handled internally.

- Role-based access controls limit system access based on job function, preventing unauthorized users from viewing sensitive customer data, modifying pricing, or processing financial transactions. Audit logs track every system action for compliance reporting and fraud investigation.

- GDPR and data sovereignty compliance matters for organizations serving European customers or operating in regions with data localization requirements. White label platforms hosting data in regional data centers and providing data processing agreements satisfy regulatory requirements without forcing organizations to build multi-region infrastructure.

Common Implementation Challenges and Solutions

Even with proven white label platforms, organizations encounter predictable challenges during marketplace deployment that preparation helps avoid.

Challenge 1: Data Migration from Legacy Systems

Moving customer records, subscription history, and financial data from legacy platforms creates migration risk. Incomplete migrations lose customer history, failed data transfers corrupt records, and mapping errors create billing discrepancies that damage trust.

Solution: Phased migration starting with net-new customers reduces risk while building confidence in the new platform. Once operations stabilize, migrate existing customers systematically with parallel runs confirming data accuracy before cutting over completely.

Challenge 2: Partner Resistance to Change

Partners comfortable with existing procurement processes resist new marketplace workflows that require learning different interfaces, modified quoting procedures, and unfamiliar customer communication patterns.

Solution: Comprehensive partner training combined with parallel system operation during transition periods lets partners adapt gradually. Demonstrating clear benefits like faster order processing, real-time commission visibility, and automated invoicing helps overcome resistance through tangible value delivery.

Challenge 3: Integration with Existing Systems

Organizations running legacy ERP systems, homegrown CRM tools, or proprietary billing platforms encounter integration challenges connecting white label marketplaces to existing infrastructure without breaking current operations.

Solution: API-first architecture in modern white label platforms provides integration points for custom connectors when pre-built integrations don’t exist. Most platforms offer professional services teams experienced in complex integrations that accelerate connection development and testing.

Making the Decision: Is White Label Right for You?

Not every organization benefits from white label cloud marketplace platforms. Understanding when to build versus buy helps avoid expensive mistakes. Use this decision framework to determine the right path for your business.

✅ Choose White Label Marketplace Platforms When:

- [ ] Time to market determines competitive advantage – You need to capture market opportunities in weeks, not months, before competitors establish customer relationships

- [ ] Budget constraints limit infrastructure investment – Capital available for marketplace deployment stays below $200,000 and operational expenses fit subscription models

- [ ] Technical resources focus on core products – Development teams build proprietary applications and services instead of infrastructure that’s already available

- [ ] Proven workflows solve distribution problems – Standard subscription management, automated billing, and multi-tier partner hierarchies address your operational needs

- [ ] Rapid scaling requires tested infrastructure – Customer and partner growth projections demand infrastructure that handles volume without custom optimization

- [ ] Multi-cloud distribution drives strategy – Business model requires presence across Azure, AWS, and Google Cloud marketplaces with unified management

- [ ] Revenue leakage threatens profitability – Manual billing processes cost 1-5% of EBITA annually through missed charges, incorrect invoicing, and failed collections

- [ ] Partner ecosystems multiply reach – Multi-tier distribution through resellers and sub-resellers extends market presence without linear headcount growth

🛠️ Consider Custom Development When:

- [ ] Unique business models require proprietary workflows – Your distribution model differs fundamentally from standard subscription, consumption, or transaction-based approaches

- [ ] Strategic differentiation comes from platform capabilities – Competitive advantage derives from marketplace features and workflows competitors can’t replicate

- [ ] Technical teams have capacity for multi-year development – Engineering resources available for 12-24 month platform builds plus ongoing maintenance and enhancement

- [ ] Budget supports $1M+ infrastructure investment – Capital and operational budgets accommodate $750,000-$2,000,000 in development costs plus $200,000-$500,000 annually for maintenance

- [ ] Control over technical decisions drives competitive advantage – Platform architecture, technology stack, and implementation details create defensible market position

- [ ] Existing infrastructure creates integration complexity – Legacy systems require deep customization that pre-built platforms can’t accommodate without extensive modification

- [ ] Regulatory or compliance requirements demand custom solutions – Industry-specific regulations require platform capabilities that white label providers don’t support

💡 Hybrid Approach Considerations:

- [ ] Start with white label, customize later – Launch quickly with proven infrastructure, then add custom features as business scales and requirements clarify

- [ ] White label core, custom integrations – Use pre-built marketplace infrastructure while building proprietary connectors to legacy systems or unique data sources

- [ ] Multi-platform strategy – Run white label marketplace for standard offerings while developing custom platforms for differentiated services or vertical-specific solutions

For most CSPs, telcos, MSPs, and ISVs, white label platforms provide faster, cheaper, and lower-risk paths to cloud marketplace success. The technology debate matters less than business outcomes: Will you generate revenue in 6 weeks or 6 months? Can you afford to build what’s already available? Will custom platforms provide competitive advantages worth the investment?

Conclusion

White label cloud marketplace platforms eliminate development burden, cost risk, and timeline delays that sink custom marketplace projects.

The cloud distribution model rewards speed and operational excellence, where first movers build partner networks, customer relationships, and revenue streams that create competitive advantages custom platforms might eventually match but timing determines who wins.

Revenue leakage through manual billing, slow provisioning workflows, and disconnected partner management drains 1-5% of EBITA annually according to industry research. White label platforms eliminate these losses through automation, real-time data integration, and tested workflows that capture every billable event without human oversight.

For CSPs, telcos, MSPs, and ISVs operating on 5-10% margins, recovering this leakage directly impacts profitability and funds growth initiatives that manual processes starve through hidden costs.

Ready to launch your white label cloud marketplace platform in weeks instead of months? Discover how AppGallop’s tested infrastructure accelerates your cloud distribution strategy without custom development risk.

Frequently Asked Questions

A white label cloud marketplace platform is pre-built marketplace infrastructure that organizations rebrand and operate as their own. These platforms include catalog management, automated provisioning, billing systems, partner management, and customer self-service portals without requiring custom development from scratch.

Most white label cloud marketplace platforms launch within 2 to 8 weeks depending on customization requirements. Basic deployments with standard cloud provider catalogs can go live in 2 weeks, while complex integrations with legacy systems, custom ISV product onboarding, and multi-geography rollouts might require 6-8 weeks.

Custom marketplace development builds proprietary platforms from scratch, typically requiring 6-12 months and $500,000-$2,000,000 in development costs. White label platforms provide pre-built infrastructure that organizations customize and brand, launching in 6-8 weeks at 60-70% lower cost while including ongoing maintenance and updates.

White label platforms calculate commissions automatically across N-tier partner hierarchies at transaction time. The system applies commission rules by partner level and product category, tracks pending payouts through real-time dashboards, and generates split invoices for each partner tier without manual calculation or reconciliation.

Yes, white label cloud marketplace platforms ingest usage data directly from cloud provider APIs, apply pricing markups, calculate consumption charges, and generate invoices automatically. The systems handle prorated billing for mid-cycle changes, multi-currency pricing, and revenue recognition compliance without manual intervention.