If you run a reseller program, your growth is tied to how fast partners can sell and how cleanly you can track deals, pricing, and payouts. That’s hard to do when everything lives across spreadsheets, emails, and CRM notes. It gets even harder as you add more partners, regions, and product lines.

This shift is also happening because buying has moved online. Gartner projected that 80% of B2B sales interactions would happen in digital channels by 2025. When buyers and partners expect digital-first selling, your reseller program needs a real portal, not a shared Google Sheet.

If you’re evaluating reseller management software (or reseller portal software), you’re likely trying to answer questions like these:

- Are partners dropping deals because they can’t see pricing, deal status, or next steps quickly?

- Do commissions and partner claims turn into monthly disputes and finance fire drills?

- Are you losing trust due to channel conflict when multiple partners chase the same account?

This guide breaks down what reseller management software includes, what to look for, and how to choose a tool that fits your reseller model.

Key Takeaways

- A reseller portal is a system for deal flow, not just a login page.

- Deal registration matters because it protects trust and reduces partner conflict.

- Onboarding speed is a revenue driver because slow setup delays your first deal.

- Commissions need rules, visibility, and approvals to prevent disputes.

- Pick software based on your reseller model: direct resale, multi-tier, or marketplace-led.

- A good setup makes partners faster without adding ops load on your team.

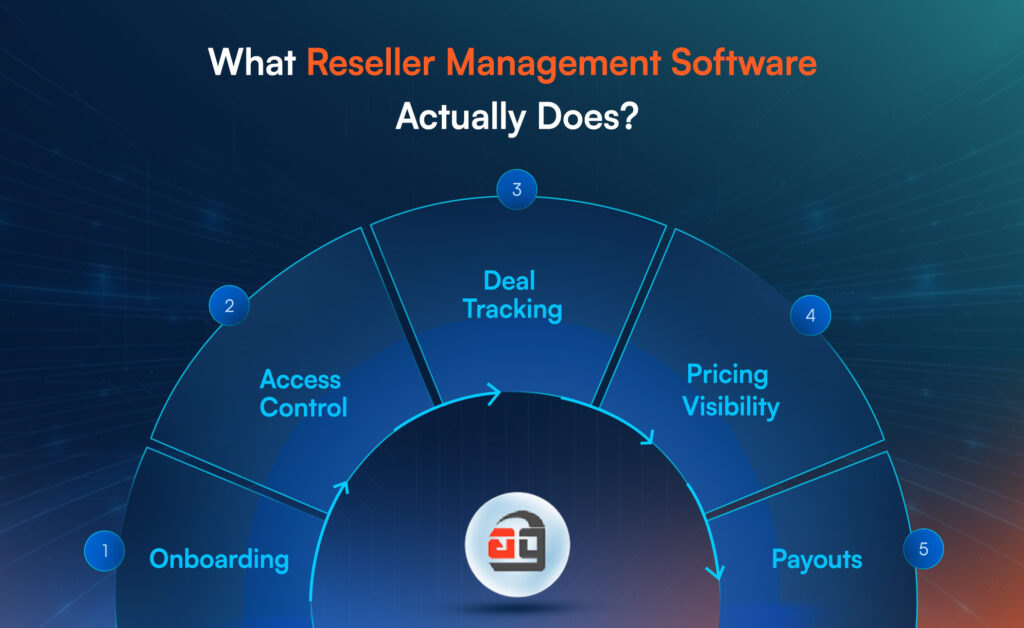

What Reseller Management Software Actually Does?

Reseller management software is built to run your partner lifecycle end to end: partner onboarding, access control, deal tracking, partner sales motion, and partner payouts. In many companies, it also overlaps with PRM (partner relationship management), partner portals, and channel sales tools.

The confusion usually comes from naming. Some vendors call it PRM. Some call it a partner portal. Some call it reseller portal software. The safer way to evaluate is by what the system runs in your day-to-day work.

Here’s a simple way to separate common tool categories.

| Tool type | What it’s meant to run | Where it usually fails |

| CRM (partner fields + workflows) | Internal tracking of accounts and partner-sourced deals | Partners don’t live inside your CRM, and visibility stays one-sided |

| Reseller portal software | Partner-facing workflow: deals, pricing, training, requests, ordering | Often weak on billing, commissions, and multi-tier rules |

| PRM software | Broader partner program ops: onboarding, enablement, MDF, deal reg | Can be strong for program ops, but may not cover commerce and billing |

| Marketplace/commerce platform | Catalog, ordering, billing, provisioning | Often needs partner program layers (tiers, margins, deal reg) added on top |

Closing thought: a reseller program breaks when the “partner-facing workflow” is weak. That’s why reseller portal depth matters.

Why Reseller Programs Break As You Grow?

Most reseller programs don’t fail because the product is bad. They fail because the operating system around the program can’t keep up. When that happens, partner trust drops, and your best resellers move on to programs that feel easier to sell.

Also, many B2B orgs expect partner-led revenue to grow. Forrester found 55% of surveyed partner ecosystem and channel marketing decision-makers forecasted indirect revenue growth above last year or significantly above last year. Growth without ops is where things snap.

Here are the breakpoints you should plan for.

1) Onboarding drags, so first revenue drags

Partners don’t want a long back-and-forth for access, agreements, product training, and deal rules. If onboarding takes weeks, the partner’s first deal gets delayed, and your program feels “hard to sell.”

2) Channel conflict becomes a trust issue

The minute two partners work the same account, you have a conflict. Even if you resolve it fairly, the program starts feeling risky to partners. Deal registration is how most programs handle this.

3) Pricing and margins live in too many places

Partners need clarity on deal pricing, discount rules, margins, and approvals. If partners can’t get answers fast, they either discount blindly or stall.

4) Deal tracking becomes email chasing

If reps and partners can’t see deal stage, next step, and ownership clearly, updates turn into meetings and follow-ups. That increases sales time without improving close rates.

5) Commissions turn into monthly disputes

When payout rules are unclear, partners raise tickets. Finance spends time reconciling partner claims. Partners feel like they need to “fight” to get paid.6) Reporting is weak, so program decisions are guesswork

If you can’t answer “which partners are growing, why, and where deals get stuck,” you can’t fix the program.

The Reseller Management Software Checklist

Before looking at vendors, align on the modules you actually need. A reseller portal that only does onboarding and training won’t solve payout disputes. A commerce system that handles orders won’t solve channel conflict.

Below is a practical checklist you can use while comparing tools.

| Module | What good looks like | Questions to ask during evaluation |

| Partner onboarding | Partner sign-up, approvals, document capture, tier assignment | Can I approve partners by region, tier, and product line? |

| Role-based access | Partners see only what they should: catalogs, pricing, training, deals | Can access change by partner tier and geography? |

| Deal registration | Partner-submitted deal, review, approval, protection window | What happens if two partners submit the same account? |

| Lead distribution | Assign leads to partners, track follow-up, and outcome | Can we track partner response time and conversion? |

| Enablement | Training, certifications, sales kits, deal playbooks | Can training completion tie to tier eligibility? |

| Quoting + approvals | Quote requests, discount approvals, and margin guardrails | Can approvals follow deal size, tier, and product line? |

| Ordering/commerce | Partner places orders, renewals, upgrades, cancellations | Can partners transact inside the portal, or is it a request form? |

| Commissions + payouts | Rules, calculations, approvals, partner visibility | Can partners see pending commissions and payout status? |

| Partner performance | Pipeline, closed-won, renewal rates, activity | Can I compare partners by region, segment, and product line? |

Short rule: if your reseller program has deal protection + payouts, your system must support both cleanly.

Deal Registration: The Section Most Teams Under-Build

Deal registration is not just a form. It’s a trust contract between you and the partner. It tells partners: “If you invest time selling this deal, we will protect your effort.”

That matters more now because channel partners are shifting toward recurring and services-led revenue. IDC reported recurring revenues grew to 42% of revenue for the typical channel partner in 2022 (up from 2019). When partner models shift toward recurring revenue, partners care even more about deal ownership and renewals.

A working deal registration process usually includes:

- Eligibility rules: Who can register a deal? What deal types qualify? What proof is required?

- Approval rules: Who approves? How fast? What are the “reject reasons” that partners can actually understand?

- Protection rules: How long is the protection valid? What actions must the partner take to keep protection?

- Visibility rules: Can partners see the status? Can internal reps see the same truth?

- Conflict rules: What happens if another partner submits the same account later?

Closing note: If deal registration is slow or unclear, partners stop using it and go back to backchannel emails.

Choosing Reseller Management Software: A Scorecard That Prevents Bad Picks

A lot of teams buy the tool that demos best, not the tool that fits their reseller motion. To avoid that, score tools using your program reality.

Here’s a simple scorecard. You can adjust weights.

| Category | Weight | What to validate? |

| Partner-facing workflow | 20% | Deals, requests, training, approvals, status visibility |

| Deal registration depth | 15% | Protection rules, conflict logic, partner visibility |

| Commerce support | 15% | Ordering, renewals, upgrades, cancellation flow |

| Commission + payout clarity | 15% | Rule setup, approval flow, partner-facing payout tracking |

| Multi-tier partner support | 10% | Distributor → reseller → sub-reseller structure |

| Pricing and margin controls | 10% | Tier-based pricing, approval rules, guardrails |

| Integrations | 10% | CRM + billing + provisioning + accounting |

| Reporting | 5% | Partner performance, funnel visibility, payout reports |

Two selection tips that save pain later:

Run a real workflow in the demo

Bring one real deal example: a reseller registers a deal, requests a discount, closes, and expects payout. If the tool can’t show that end-to-end, it’s not your system.Test partner experience, not just admin controls

Your internal team can work around rough edges. Partners won’t.

Top Tools: What Different Platforms Usually Fit?

This is not a “best tools” list. It’s a fit map based on common patterns in the market.

| If your reseller program is mainly… | You usually need a platform that is strong in… | Watch-outs |

| Program-led (onboarding, training, deal reg) | PRM + reseller portal depth | Commerce and billing may still be outside |

| Commerce-led (orders, renewals, upgrades) | Marketplace/commerce layer | Partner program controls can be thin |

| Multi-tier (distributor + resellers) | Tier logic, pricing rules, payouts across tiers | Reporting and payout clarity often break first |

| High-volume SMB resellers | Fast onboarding + clear pricing + quick ordering | Discount approvals can slow everything |

Quick reality check: your “reseller program” might actually be two programs in one: a top-tier group that needs deal protection, and a long tail that needs easy ordering. Your tool choice has to handle both.

How AppGallop Helps Reseller Management Teams?

AppGallop supports reseller management when your program needs more than onboarding and deal tracking. It’s built to handle complex partner structures and commerce workflows, especially for CSPs, MSPs, telcos, and ISVs running multi-tier distribution.

AppGallop helps you run the parts that usually break first:

- Multi-tier Partner Hierarchy

- Deal Registration

- Partner-Specific Pricing and Margins

- Commission Calculations across Partner Level

It also supports reseller storefront models so partners can sell through a branded experience while you keep control of catalog, pricing rules, and tracking.

If your reseller model ties directly to billing, renewals, upgrades, and payouts, AppGallop is designed to keep those flows connected so ops and finance aren’t forced to reconcile everything by hand.

If you want help mapping your reseller program flows to the right reseller portal setup, AppGallop can walk you through what a working partner workflow looks like for your model.

Fill this form to book a Free Demo with us Today!

Conclusion

Reseller management software is not about adding another tool. It’s about giving partners a clear way to sell and giving your team a clean way to track deals, pricing, and payouts. The best systems reduce channel conflict, speed up onboarding, and remove commission disputes before they start.

FAQs

Reseller management software is a system that helps you run partner onboarding, deal registration, reseller portals, ordering or deal flow, and partner payouts. It’s meant to reduce manual partner ops and give partners visibility into what they need to sell.

At minimum: partner onboarding, role-based access, deal registration, enablement content, discount or pricing approvals, and partner performance tracking. If you pay commissions, the portal should also show payout status and rules clearly.

Use deal registration with clear rules: eligibility, approval timeline, protection window, and conflict handling. Partners need confidence that their work won’t be taken by another partner after they invest time selling.

Track partner-sourced pipeline, close rate, time-to-first-deal for new partners, registered deal approval time, renewal rate (if recurring), and payout dispute rate. If payout disputes are rising, trust is dropping.