Most MSPs do not lose money because they lack clients. They lose money because finance stays fuzzy at scale. A few missed time entries, a few invoices sent late, a few renewals not aligned to usage, and suddenly your “growing” MSP feels cash-starved.

The issue is that MSP finance is not one job. It is a connected system: service delivery creates billable value, billing turns it into invoices, collections turns it into cash, and reporting tells you whether the work was worth doing.

When these parts sit in different tools without tight rules, you get the classic symptoms: billing surprises, margin arguments, and a month-end close that depends on spreadsheets and heroics.

A useful benchmark to keep in mind is Days Sales Outstanding. In APQC benchmarks, the median DSO is 38 days, with top performers at 30 days and bottom performers at 46 days. (Gartner)

That spread is often the difference between “we can invest” and “we are always catching up.”

MSP financial management software exists to give you control across billing, profitability, and recurring revenue without slowing down delivery.

Key Takeaways

- You need one source of truth for contracts, time, usage, and invoices to stop revenue leakage.

- Profitability improves when you track margins by client, service line, and engineer time.

- Cash flow gets healthier when billing and collections run on clear weekly routines, not month-end panic.

- Cloud and subscription resale adds complexity, so billing must handle proration, renewals, and usage.

- The best setup connects PSA, accounting, and billing with consistent rules and approvals.

- Choose software based on your billing model today and the marketplace model you want tomorrow.

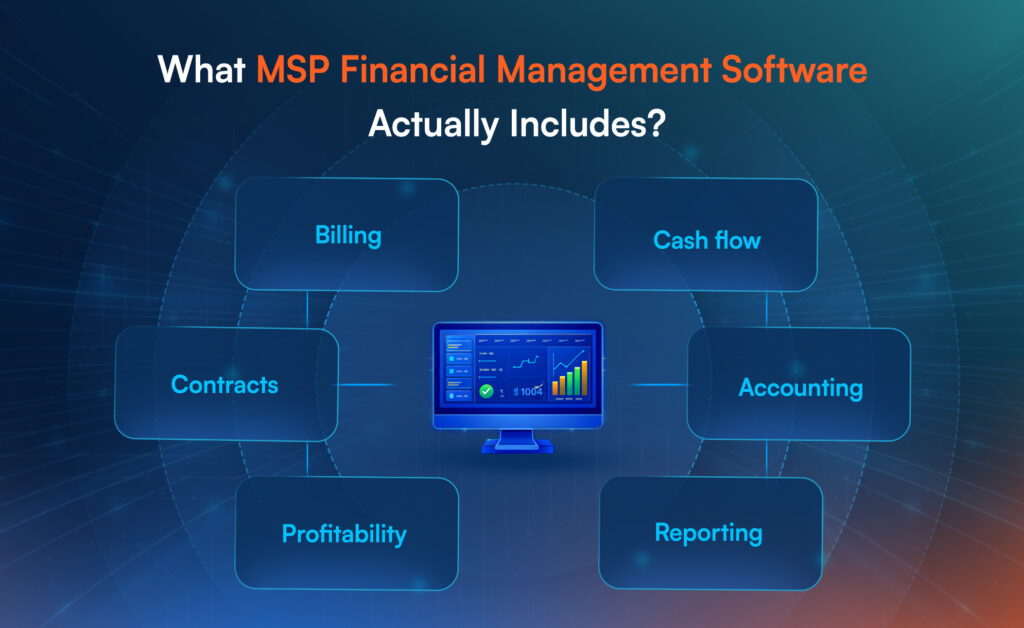

What MSP Financial Management Software Actually Includes?

MSP financial management software is not a single tool category. In practice, it is a finance layer built across multiple systems that behave like one workflow.

Here is the typical scope:

- Billing And Invoicing: recurring invoices, proration, one-time charges, usage billing, tax handling

- Contract And Revenue Management: agreements, renewal dates, price changes, minimums, bundles

- Profitability Tracking: margins by client, ticket, project, and service line

- Cash Flow Visibility: AR aging, DSO, expected collections, overdue risk

- Accounting Integration: sync to accounting platforms, chart of accounts mapping, revenue recognition support

- Reporting: monthly close dashboards, variance checks, service desk-to-revenue alignment

If you only “do billing” but you cannot explain the margin by the client, you are still guessing.

Why MSP Finance Breaks As You Scale?

Most MSPs start with a simple setup: a PSA, an accounting tool, and a billing routine. The breakdown happens when your delivery complexity grows faster than your finance system.

Common causes:

Billing Becomes Too Complex For Manual Checks

You add new services, bundles, cloud licenses, security add-ons, and project work. Each has different billing logic. Manual review turns into “best effort.”

Time And Work Do Not Translate Cleanly Into Revenue

If time entries are late, incorrectly tagged, or not tied to the right agreement, billing accuracy drops, and profitability becomes a debate.

Cloud And Subscription Resale Adds A Second Revenue Engine

Cloud and SaaS resale introduces usage, proration, renewals, and vendor reconciliation. Your finance team needs more than “monthly recurring invoices.”

This is where broader cloud spend reality matters. Gartner forecasts worldwide public cloud end-user spending reaching $723.4B in 2025 (iofm.com), which keeps pushing more MSP revenue into cloud and subscription models.

Cash Flow Risk Increases Even If Sales Looks Fine

In India, Atradius reports that just over half of B2B credit sales remain outstanding at the due date, and it takes an average 34 days beyond due to convert invoices into cash (Atradius).

That is exactly why MSPs need predictable invoicing and collections systems, not reactive chasing.

Core Capabilities Checklist

You can use this checklist as a quick “fit test” when evaluating MSP financial management software.

Billing And Invoicing Capabilities

Look for:

- Recurring billing with proration and mid-cycle changes

- One-time charges (projects, hardware, onboarding)

- Usage-based billing (cloud, licenses, metered services)

- Tax support for your region (GST in India, sales tax/VAT elsewhere)

- Approval workflows before invoices go out

- Invoice batching and customer-specific formats

Profitability And Cost Tracking Capabilities

Look for:

- Margin by client and by agreement

- Time and expense attribution rules

- Project profitability view (planned vs actual)

- Service line reporting (security, cloud, helpdesk, compliance)

- Write-off tracking and root-cause tagging

Cash Flow And Collections Capabilities

Look for:

- AR aging dashboards

- Automated reminders and follow-ups

- DSO tracking and targets

- Credit risk signals and dispute tracking

Late payment risk is real in both regions. Atradius’ US survey highlights that late payments remain a major issue and bad debts average 8% of B2B credit sales in its 2024 report (Atradius).

KPIs That Make MSP Finance Actionable

If your dashboard only shows revenue, you will miss the real story. Use KPIs that connect delivery to money.

| KPI | What It Tells You | Why It Matters |

| MRR By Service Line | What you truly sell | helps you double down on high-margin lines |

| Gross Margin By Client | Who funds your growth | stops “busy but broke” accounts |

| Effective Bill Rate | What time is worth | reveals pricing and utilization issues |

| DSO | How fast can you convert invoices to cash | controls cash flow without borrowing |

| Agreement Attach Rate | How well you bundle services | drives stickiness and higher ARPA |

| Write-Off Rate | How much value do you lose | shows process gaps and scope issues |

A useful view is also the finance function efficiency. A CFO.com summary of APQC benchmarks notes that top quartile finance functions can operate at around 0.66% of revenue in cost.

You do not need to chase that number immediately, but it is a signal: the goal is fewer manual steps and fewer exceptions.

Building Your MSP Finance Stack

Most MSPs end up with a “stack,” not a single platform. What matters is how the stack behaves.

The Typical Stack Pattern

| Layer | What It Owns | Examples Of Outputs |

| PSA | tickets, time, projects, agreements | billable time, project milestones |

| Billing Engine | recurring invoices, proration, usage | invoice lines, renewals, true-ups |

| Accounting | GL, reconciliation, financial statements | P&L, balance sheet, tax reporting |

| Payments And Collections | reminders, payment links, AR workflows | cash application, aging reduction |

| Marketplace Ops | cloud catalogs, provisioning, vendor sync | usage data, subscription changes |

When you connect these layers with clean rules, you reduce exceptions. APQC-based reporting cited by CFO.com shows that companies with 80% of invoices issued electronically had DSO around 30 days, versus 55 days for those with low e-invoicing adoption (Gartner).

The takeaway for MSPs is simple: fewer manual invoice steps usually means faster cash collection.

Who Uses MSP Financial Management Software And Why?

MSP financial management software is used by teams who have moved past “basic invoicing” and now need finance to drive decisions, not just close books.

You typically see adoption when the MSP starts feeling at least one of these pressures: more service lines, more recurring contracts, more cloud resale, more projects, or more compliance requirements across regions.

Common User Groups

- MSP Owners And GMs

You want to see margin by client and understand which services actually fund growth. - Finance Teams

You want predictable month-end close, fewer invoice disputes, and clean audit trails. - Operations Leaders

You want delivery data to map cleanly to billing, so you stop firefighting at invoice time. - Sales And Account Managers

You want renewals, upgrades, and true-ups to be visible so revenue does not depend on memory.

Multi-Region MSPs (US + India + Global Customers)

You want multi-currency, regional taxes, and consistent reporting without running parallel systems.

How To Choose The Right MSP Financial Management Software?

Instead of comparing feature lists, compare how well a tool supports your billing model.

Step 1: Identify Your Revenue Mix

Ask: what percent of revenue is helpdesk agreements, project work, cloud resale, security add-ons, and hardware?

Step 2: Map Your Billing Complexity

You need to support:

- Fixed monthly bundles

- Per-user or per-device pricing

- Project milestone billing

- Usage and consumption (cloud)

- Mid-cycle changes and proration

Step 3: Test The “Exception Workflow”

Most finance pain comes from exceptions, not normal invoices.

Ask vendors:

- What happens when time is missing?

- What happens when pricing changes mid-month?

- What happens when a customer disputes a charge?

- Can we trace every invoice line back to a ticket, contract, or usage event?

Step 4: Confirm Integration Reality

Integration is not “we have a connector.” It is: does data sync with the right mapping, approvals, and reconciliation support.

Implementation Plan For The First 90 Days

A fast rollout works when you treat it as a process upgrade, not a tool switch.

Days 1–30: Build The Rules

- Define billable vs non-billable rules

- Standardize agreement structures and service codes

- Lock the “source of truth” for products, rates, and taxes

- Create invoice approval ownership

Days 31–60: Automate The Core Cycle

- Automate recurring invoices

- Set proration rules

- Align time entry requirements with billing deadlines

- Build AR aging and reminder routines

Days 61–90: Add Profitability And Forecasting

- Start margin reporting by client and service line

- Add renewals and expansion tracking

- Set DSO targets and collection triggers

- Build a monthly finance review cadence with ops and sales

AppGallop For MSP Financial Operations In Cloud Marketplaces

If your MSP sells cloud and SaaS, finance becomes a marketplace workflow problem: catalog changes, subscription upgrades, usage true-ups, and renewals must translate into accurate billing and clean reporting.

AppGallop helps you run that layer like an operating system. You can manage cloud catalogs, subscription lifecycle changes, and billing events in a controlled flow so finance is not chasing spreadsheets.

It also supports the quote-to-cash path for cloud resale, including subscription modifications and renewal visibility, which reduces invoice disputes and improves cash predictability.

When marketplaces become a bigger share of revenue, this “ops to invoice” connection is what keeps margins measurable and month-end close stable.

Book a Free Demo Today if you want to see how AppGallop can help in your Financial Management

Conclusion

MSP financial management software is not about “better invoicing.” It is about making finance measurable across delivery, billing, collections, and profitability. When you connect PSA activity to billing logic and accounting records, you reduce revenue leakage, shorten cash cycles, and make margin decisions with confidence.

If your MSP is adding service lines, selling more cloud, or operating across regions, now is the right time to upgrade the system before finance becomes a growth bottleneck. Use the KPI framework above, implement in 90 days, and make billing and profitability a weekly operating habit.

FAQs

MSP financial management software is a system that connects PSA data, billing workflows, and accounting records so you invoice accurately, track profitability, and manage recurring revenue in one process.

You get the best results with a PSA because time, tickets, and agreements feed billing, but you can still improve finance if your billing and accounting workflows are well-structured.

MSP financial management software helps with profitability by showing margin by client, service line, and project, so you stop subsidizing unprofitable accounts and fix pricing or scope fast.

Yes, cloud-ready setups handle proration, subscription upgrades, and usage true-ups, which is essential when your MSP revenue includes cloud resale and SaaS subscriptions.

Implementation usually takes a few weeks to set billing rules and integrations, then one to two billing cycles to stabilize the workflow and start reliable profitability reporting.