What Is Dunning Management Software?

Dunning management software automates the recovery of failed payments and overdue invoices using retry logic, personalized reminders (email/SMS/in-app), and secure self-service payment updates. The goal is simple: reduce involuntary churn and protect recurring revenue.

Here’s why teams finally take dunning seriously: ProfitWell estimates 20–40% of churn can come from “needless” payment issues (as cited by GoCardless), like failed or expired cards.

Now ask yourself:

- Are failed renewals and card expirations quietly driving churn every month?

- Is your finance or support team still chasing “payment failed” tickets manually?

- Do partner-led accounts (MSPs/resellers/telco channels) slip through the cracks when billing fails?

If any of these are true, you do not need more reminders. You need a system.

Key Takeaways

- Dunning works best when you combine retry logic, customer self-serve payment updates, and timed messaging.

- The “best” tool depends on your billing model: subscriptions, usage, invoices, or partner-led accounts.

- Native billing tools are faster to deploy, while dedicated recovery tools give deeper control and testing.

- Track recovery rate, churn saved, and failure reasons weekly so dunning improves over time.

- For telcos and CSPs, dunning must connect to entitlements (pause/suspend/reactivate) and partner workflows.

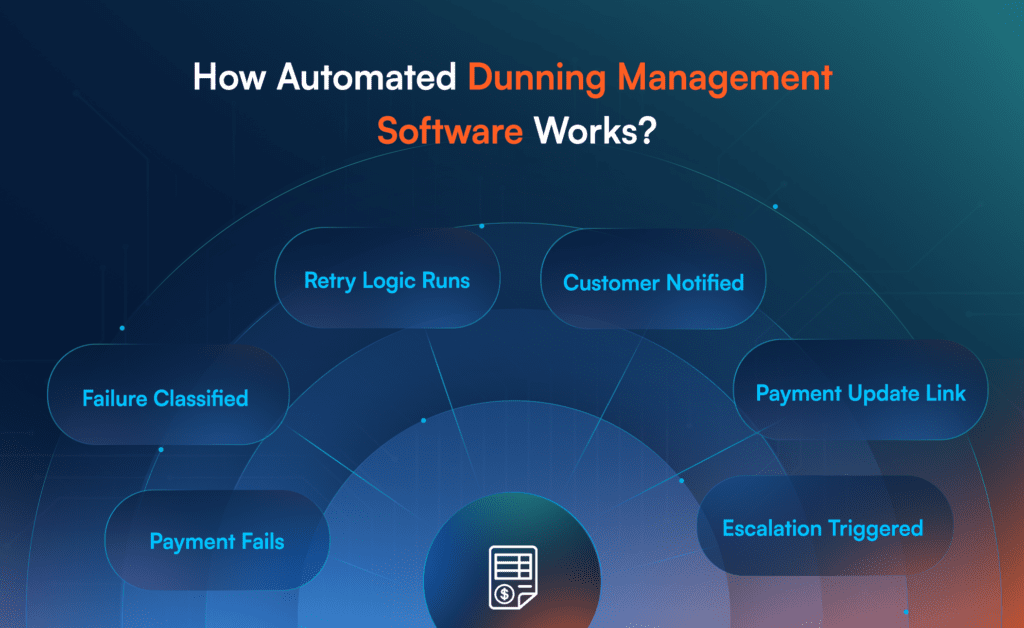

How Automated Dunning Management Software Works?

Automated dunning management software is a rules-driven system that detects a failed payment or overdue invoice and then runs a recovery sequence using retries, customer notifications, and a secure payment update flow. It aims to recover revenue without manual follow-up while keeping the customer experience consistent.

A typical flow looks like this:

- A subscription renewal or invoice payment fails

- The system classifies the failure (temporary vs customer action required)

- Retry rules run (smart retries or configurable schedules)

- Reminders go out (email/SMS/in-app) with the right tone and timing

- The customer gets a secure link to update payment details

- If unresolved, the system escalates (pause service, suspend, or handoff to AR)

For ISVs, CSPs, MSPs, and telcos, the best flow is the one where recovery actions do not break provisioning, access, or partner accountability.

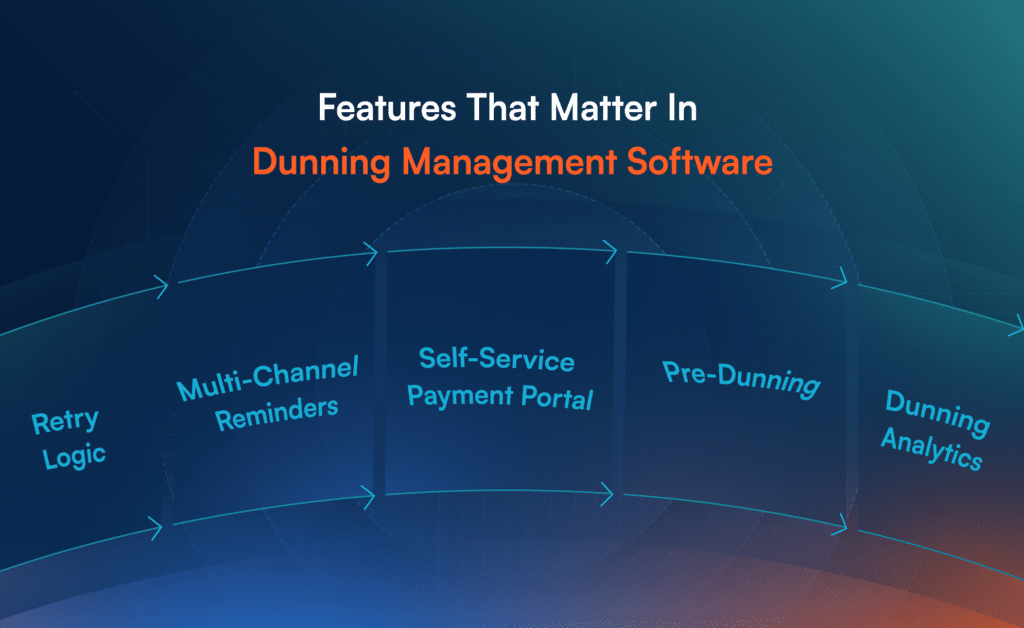

Features That Matter In Dunning Management Software

Not all dunning features carry equal weight. For subscription and recurring billing businesses, the outcome usually depends on a few fundamentals: how retries run, how fast customers can fix payment details, and how clearly you can measure recovery performance.

- Retry Logic That Matches Real Failure Patterns

“Retry every 3 days” is simple, but it is not always effective. Better tools let you adapt cadence by failure type, segment, and timing patterns that increase approval likelihood.

- Multi-Channel Reminders That Stay Helpful

Email is table stakes. SMS and in-app notifications matter when billing contacts are not product users, which is common in B2B, telecom, and MSP models. The best setups avoid noisy frequencies and focus on clarity and timing.

- Customer Self-Service Payment Portal

This is the make-or-break moment in most recoveries. The faster a customer can update payment details securely, the fewer tickets your team handles and the more revenue you recover.

- Pre-Dunning For Expiring Cards

Pre-dunning reduces avoidable failures by prompting customers to update expiring cards before renewal day. It is especially useful in markets where card rotation and re-issuance are frequent.

- Dunning Analytics And Reporting

If you cannot see what fails, you cannot improve it. You should be able to track recovery rate, revenue at risk, and top failure reasons, then tune retry rules and messaging based on patterns.

Payment failures are not “rare edge cases.” Chargebee cites an average transaction failure rate of 35% (and notes it can be higher in some scenarios).

You don’t need to agree with the ceiling to accept the point: failures are frequent enough to justify automation.

Best Dunning Management Software For ISVs, CSPs, MSPs, And Telcos

Different tools are built for different billing realities. Below is a practical shortlist that covers subscription-first recovery tools as well as invoice-heavy and enterprise AR workflows where needed.

Quick Comparison

| Tool | Best Fit | Strength |

| AppGallop | Telcos, CSPs, MSPs, ISVs | Cloud commerce billing + dunning aligned to marketplace + partner operations |

| Paddle Retain | ISVs using Paddle | Built-in failed payment recovery + retention offers |

| Stripe Billing | Stripe-first teams | Retry tooling inside Stripe ecosystem |

| Chargebee | Chargebee billing users | Decline-aware retries + configurable dunning flows |

| Churn Buster | High-volume subscriptions | Strategy-heavy recovery workflows |

| Recurly | Subscription lifecycle teams | Subscriber lifecycle + retries + churn tooling |

| Gravy | High LTV subscriptions | Human-assisted recovery follow-ups |

| Zoho Billing | India-leaning SMB/mid-market | Configurable subscription dunning |

| HighRadius | Enterprise AR teams | Invoice dunning + AR workflow automation |

| Pabbly Subscription Billing | Budget-friendly teams | Basic retries + reminders |

As requested, this list does not include AppXite, Appdirect, Inficterra, or Cloudblue.

- AppGallop

Most dunning tools assume a simple setup: one seller, one customer, one subscription. ISVs, CSPs, MSPs, and telcos often operate with more moving parts: usage billing, invoices, bundles, provisioning dependencies, and partner-led accounts.

AppGallop fits when dunning must work inside a cloud commerce program where you sell recurring and usage offers through a marketplace model and need billing recovery aligned with catalog, provisioning, and entitlement rules.

What you typically need in this model:

- Support for subscriptions, invoices, and usage-based charges

- Retry policies that reflect failure type and customer segment

- Pre-dunning for expiring cards and upcoming renewals

- Secure self-service payment updates

- Recovery workflows connected to service states (pause/suspend/reactivate)

- Reporting across churn saved, recovery rate, and revenue at risk

- Partner context (who owns the customer relationship and what happens on non-payment)

If billing failures currently create confusion across finance, support, and provisioning, the biggest impact comes from connecting dunning to how your cloud commerce operations actually run.

Book a Free Demo Now to See us live with all your Dunning related requirements!

- Paddle Retain

Paddle Retain is designed for failed payment recovery inside the Paddle ecosystem. It is a strong fit for ISVs already billing through Paddle who want recovery without stitching multiple systems together.

Paddle claims it can cut involuntary churn by up to 17% using Retain’s recovery approach.

Treat that as a vendor claim, but it signals what the product is optimized for: failed-payment recovery and retention moves tied to billing.

- Stripe Billing

Stripe Billing is often the simplest choice when Stripe is already your payment backbone. It can help you start with retry policies and recovery basics, then layer messaging and customer UX once you see the dominant failure reasons.

It is a fit when speed matters and you want fewer moving parts across your billing stack.

- Chargebee

Chargebee is typically a strong fit when Chargebee is already your subscription billing hub and you want configurable dunning flows with decline-aware behavior. It is commonly shortlisted by teams that want structured sequences and reporting without building everything from scratch.

It is most effective when you use Chargebee as the system of record for subscription billing.

- Churn Buster

Churn Buster is often chosen when recovery is already a priority KPI and you want deeper levers around segmentation, messaging, and performance improvement. It tends to suit high-volume subscription businesses that treat dunning as a measurable growth lever.

- Recurly

Recurly works well for teams that want a broader lifecycle view, where subscription management and churn tooling live alongside payment recovery. It is a fit when you want dunning as part of a larger subscription platform approach.

- Gravy

Gravy stands out with human-assisted recovery. If your customer value supports higher-touch outreach, human follow-up can lift recovery in segments where automation alone does not work well.

- Zoho Billing

Zoho Billing is a common option for subscription businesses that want configurable dunning with a practical setup. It tends to show up often in India-leaning evaluations where cost and simplicity matter.

- HighRadius

HighRadius is usually a better fit for finance-led teams managing invoice dunning and AR workflows at scale. It is most relevant when your main recovery motion is invoice-based and enterprise-grade.

- Pabbly Subscription Billing

Pabbly can be a workable entry option if you need basic retries and reminders on a tighter budget. It is typically less suited for complex billing models and enterprise controls.

How To Choose The Best Dunning Management Software For Your Billing Model?

Selection gets easier when you start from your billing reality. A tool can look “best” in a list, but still fail if it cannot match your billing types, customer ownership model, or entitlement actions.

Use this checklist:

- Does it support your billing mix (subscriptions, usage, invoices, partner-led)?

- Can you configure retry logic by failure reason and segment?

- Does it offer a secure, fast self-service payment update flow?

- Does it support pre-dunning for expiring cards?

- Are analytics clear enough to tune cadence and messaging?

- For telcos/CSPs/MSPs: can dunning connect to entitlements and provisioning actions?

If your recovery motion needs coordination across partners, provisioning, and finance, prioritize fit and operational alignment first, then look at messaging depth and optimization options.

Conclusion

Dunning management software is only “basic automation” when the billing model is simple. For ISVs, CSPs, MSPs, and telcos, it becomes part of how you protect recurring revenue across subscriptions, usage, invoices, and partner-led accounts. The best tools do not just retry payments.

They help customers fix issues quickly, keep communication consistent, and align recovery actions with service access and internal ownership. If you are choosing a solution, start with billing-stack fit and entitlement impact, then judge retry logic, self-serve UX, and reporting depth. That is how dunning turns into churn saved.

FAQs

The difference between dunning management software and collections software is that dunning management software focuses on early-stage recovery using retries, reminders, and self-service updates, while collections software focuses on late-stage recovery for seriously overdue accounts that may require formal collections workflows.

How many retry attempts automated dunning management software should run depends on your failure patterns, customer segments, and payment methods, so you set a starting cadence and then adjust based on which decline reasons recover with retries versus which require customer action.

Dunning management software reduces involuntary churn by recovering revenue lost to failed payments and by helping customers update payment details quickly through secure self-serve flows, timed reminders, and sensible retry logic.

What telcos and CSPs should look for specifically in dunning management software is alignment with entitlements and provisioning actions, support for partner-led accounts, and coverage across subscriptions, usage billing, and invoices so service states follow consistent rules on non-payment.