Cloud billing software sits at the centre of how modern cloud businesses make money. It handles recurring charges, usage-based charges, and one-time fees, then turns that into invoices, payments, and finance-ready reporting.

This matters more now because cloud spend keeps rising. Gartner forecasts that worldwide public cloud end-user spending will total 723.4 billion in 2025 (Gartner).

If you are a CSP, MSP, telco, or ISV, the hard part is not “sending invoices.” The hard part is matching what you sold, what you provisioned, what you measured, and what you billed, across customers, partners, and regions.

Three questions to keep in mind as you read:

- Are you losing revenue because usage is tracked in one place, but billing happens somewhere else?

- Are private pricing, discounts, and partner margins turning every invoice into a manual check?

- Can your finance team close the month without reconciling five different exports?

Key takeaways

- Cloud billing software is not just invoicing; it links usage, pricing, tax, payments, and reporting.

- For CSPs and telcos, multi-tenant billing and partner flows matter as much as subscriptions.

- Usage-based pricing is rising, so metering and rating need clean rules, not spreadsheets.

- The best billing setup connects order, provisioning, and billing so invoices match reality.

- Pick a billing system based on your go-to-market motion, not just feature checklists.

Implementation goes faster when you start with one pricing model and then expand.

What is Cloud Billing Software?

Most search results mix two different needs:

- SMB billing tools: create invoices, track payments, and handle tax basics.

- Provider-grade billing: manage subscriptions, usage rating, partner billing, and finance close.

Both are “cloud billing software” in search. But CSPs, MSPs, telcos, and ISVs usually need the second category.

Cloud billing software is the system that:

- takes contracts and pricing rules

- pulls usage or entitlements

- applies tax and currency logic

- generates invoices and payment events

- creates reports that finance can use

If you are selling cloud services, your billing system is also your control system. It decides what you charge, when you charge, and how you explain it to the customer.

Cloud Billing Software vs Cloud Provider Billing

This is a common confusion, especially in India search results, where “cloud billing” can mean Google Cloud Billing or AWS billing pages.

Here is the difference:

| Term people search | What it actually refers to | Who it is for |

| Cloud provider billing | Your AWS/Azure/GCP invoice for cloud resources | Cloud buyers managing infra spend |

| Cloud billing software | A system you use to bill your customers | ISVs, CSPs, MSPs, telcos selling services |

| Subscription billing software | Billing focused on recurring plans | SaaS and ISVs |

| Usage-based billing software | Billing tied to consumption and metering | SaaS, cloud platforms, telcos, CSPs |

If you sell through marketplaces, you may deal with hyperscaler settlement files too. That still does not replace your internal billing system. It adds one more layer you have to reconcile.

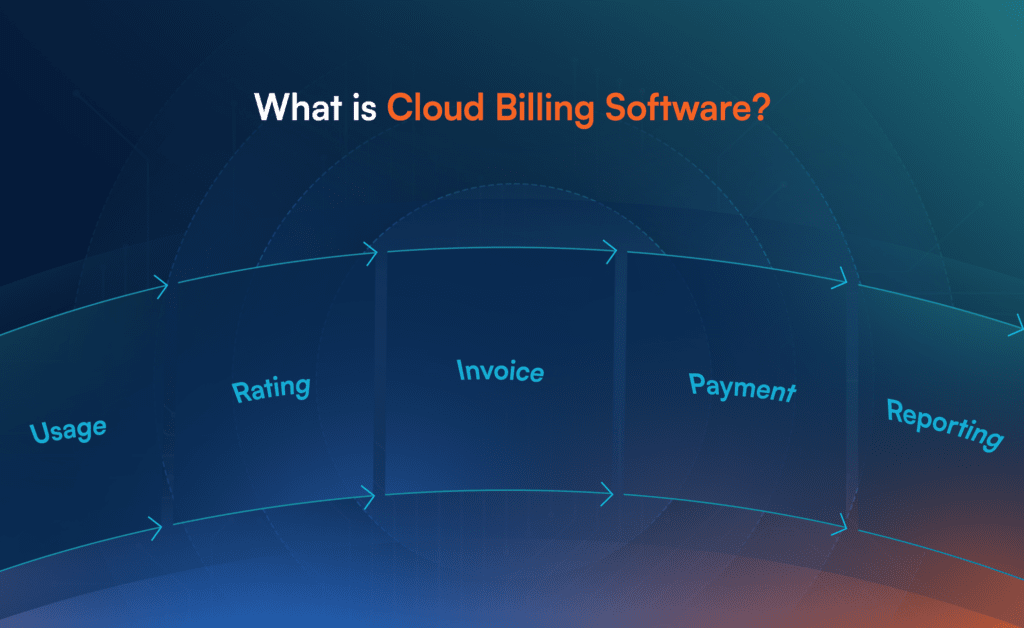

How Cloud Billing Software Works Step-by-Step?

A good billing system follows a clear chain. If any link is weak, you get disputes, credits, delayed collections, or revenue leakage.

| Step | What happens | What breaks when it is manual |

| 1. Define pricing | Plans, tiers, add-ons, overage rules, discounts | Too many custom exceptions per deal |

| 2. Collect usage | Meter events, license counts, API calls, and seats | Usage data is late or incomplete |

| 3. Rate usage | Convert raw usage into billable units | Different teams calculate differently |

| 4. Invoice | Create invoice lines that customers can understand | Line items look random, disputes rise |

| 5. Collect payments | Cards, ACH, invoice terms, reminders | Failed payments go unnoticed |

| 6. Recognize revenue | Map invoices to revenue recognition rules | Finance needs manual adjustments |

| 7. Report | MRR/ARR, churn, collections, tax | Reporting does not match reality |

Two terms are worth calling out for CSPs and telcos:

Mediation: turning raw events into clean usage records.

Rating and charging: applying the rules that convert usage into charges.

If you run multi-tenant billing, mediation, and rating are usually where complexity sits.

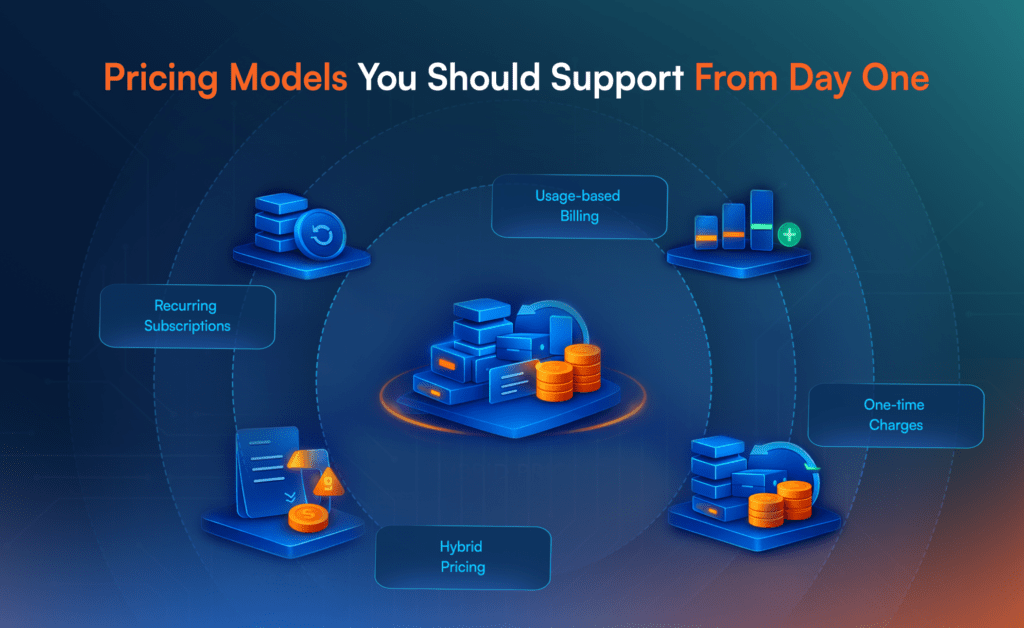

Pricing Models You Should Support From Day One

Most teams start with a simple subscription, then add usage, then add one-time services. The problem is that many billing tools handle one model well, but struggle once you mix them.

Here are the models you should assume you will need:

- Recurring subscriptions: monthly and annual plans, proration, upgrades, and downgrades.

- Usage-based billing: metered usage, tiered usage, minimum commitments, and overages.

- One-time charges: setup fees, services, onboarding, and device fees.

- Hybrid pricing: base subscription plus usage-based add-ons.

OpenView reports that 46% of SaaS companies take a hybrid approach, and 15% have a largely usage-based model (OpenView).

That shift affects CSPs and telcos too, because customers want pricing that matches consumption and business value.

Core features to look for in cloud billing software

This section is the “what you should be able to do” list. The goal is not to tick every box. The goal is to avoid the failure points that show up once you scale.

Billing operations features

- Automated invoicing: scheduled invoices, clear line items, credits, and adjustments.

- Proration rules: upgrades and downgrades without manual maths.

- Dunning management: retries, reminders, payment follow-ups, and failed payment handling.

- Tax handling: tax rules, exemptions, multi-region basics.

- Multi-currency support: pricing and invoicing across regions.

- Collections visibility: ageing reports, overdue tracking, write-offs.

Product and revenue features

- Metering inputs: API events, usage logs, license counts, seat changes.

- Rating rules: tiers, bundles, minimum commits, rounding rules.

- Revenue recognition hooks: the fields finance needs, even if rev rec is done in ERP.

- Contract change tracking: what changed, when it changed, who approved it.

Integration features

- CRM integration: quote, order, account data.

- ERP and accounting integration: invoices, credits, tax, payouts.

- Provisioning integration: entitlements reflect purchases.

- Support integration: ticket context linked to subscription and plan.

What Matters Most For Each Buyer Type?

If you want this blog to match real search intent, you need to speak to each persona’s version of “billing pain.”

If you are an ISV or SaaS vendor

Your billing problems usually show up as:

- subscriptions that do not match usage

- messy upgrades and downgrades

- payment failures that quietly become churn

- MRR reports that do not match finance numbers

Recurly reports an overall churn benchmark of 3.27%, with involuntary churn at 0.86% (Recurly). Involuntary churn is often billing and payment-related. That means billing is part of retention, not just finance.

What to prioritise:

- clean plan changes and proration

- dunning and retry logic

- usage rating rules that match contracts

- audit trail on changes

If you are a CSP or MSP

CSP and MSP billing usually breaks because of:

- multi-tenant customer billing, each with custom terms

- bundles that combine third-party and your own services

- partner or reseller markups

- service activation that does not match billing start dates

What to prioritise:

- multi-tenant billing structures

- partner billing and reseller pricing rules

- provisioning-to-billing alignment

- settlement and reconciliation workflows

If you are a Telco

Telco billing adds layers like:

- rating and charging across products and bundles

- complex hierarchies (parent, child, departments)

- partner settlements and commissions

- heavy compliance and audit needs

What to prioritise:

- mediation and rating flexibility

- strong account hierarchies

- partner settlements and payout logic

- reporting that supports audits

If you sell across regions (US + India intent)

India often expects GST-friendly invoicing language. US search leans toward subscription management and revenue reporting.

If you sell in both, you need:

- tax logic that can adapt by region

- invoice formats that match local expectations

- multi-currency and multi-entity support

- reporting that can roll up across regions

Common Problems and How to Fix Them?

This is what most teams are really searching for, even if the query is just “cloud billing software.”

- Revenue leakage from usage mismatches

When usage lives in product logs and billing lives in finance tools, leakage is common. The fix is not “more reports.” The fix is a clear metering and rating path where usage events are validated, then rated with one set of rules.

- Long quote-to-cash cycles

Deals slow down when pricing changes require manual approvals, edits, and rework. A billing system should store pricing rules in a structured way, so a private price is not a one-off spreadsheet.

- Month-end close turns into reconciliation work

If your system cannot tie invoices, payments, credits, and settlements into one view, finance ends up reconciling exports.

MarketsandMarkets estimates the cloud billing market will grow from 3.0 billion in 2020 to 6.5 billion by 2025 (MarketsandMarkets).

That growth is happening because more companies are facing this exact problem at scale.

Billing Stack Sprawl

Many teams end up with:

- One tool for invoices

- One tool for usage

- One tool for payments

- One tool for reporting

That split can work at a small scale, then becomes hard to run. A good approach is to pick one system as the “billing source of truth,” then integrate around it.

How to Choose Cloud Billing Software?

Use this as a quick filter before product demos. It keeps conversations practical.

| Question | Why it matters | What a good answer looks like |

| Can it handle hybrid pricing? | Most pricing ends up hybrid over time | Subscription + usage with clear rules |

| Can it rate usage with tiers and commits? | Usage billing is not just “count events.” | Tier rules, minimums, overages |

| Does it support proration and plan changes? | Most churn issues start here | Clean upgrades, downgrades, credits |

| How does it handle partner billing? | CSP and telco deals often include partners | Partner pricing rules and reporting |

| Can it integrate with provisioning? | Billing must match service access | Orders map to entitlements |

| Can finance close without exports? | Month-end speed affects cash flow | Reconciliation-ready reporting |

Tip: pick your “first motion.”

If your first motion is “subscription only,” pick for that and confirm a path to usage.

If your first motion is “usage first,” pick for metering and rating and confirm invoicing clarity.

Implementation Plan That Avoids Rework

Most billing rollouts fail because teams try to switch everything at once. A safer plan is staged.

Phase 1: define the billing model

Plans, usage units, discounts, tax rules, and invoice format.

Phase 2: connect the data

CRM to billing for customers and contracts. Product or platform to billing for usage.

Phase 3: test billing events

Proration, renewals, refunds, credits, and failed payments.

Phase 4: go live with one segment

One product line, one region, or one customer segment.

Phase 5: expand to partners and regions

Partner markups, commissions, GST rules, and multi-currency.

MarketsandMarkets also forecasts the subscription and billing management market will grow from 4.0 billion in 2020 to 7.8 billion by 2025 (MarketsandMarkets).

More teams are buying billing platforms because staged rollouts reduce billing risk.

Why AppGallop is The Best Cloud Billing Software?

Cloud billing gets hard when you move past basic subscriptions. You start mixing recurring plans with usage, custom terms, taxes, partner markups, and service activation. That is where teams need one place to keep selling, service delivery, billing, and finance reporting in sync.

When AppGallop is a fit

AppGallop is a fit when you sell cloud services through direct sales, partners, or marketplaces and you need billing that can handle more than simple invoices.

This is usually a match if you have:

- Hybrid pricing: a base plan plus usage, add-ons, or one-time fees

- Multi-tenant billing: many customers, each with different terms

- Partner billing: reseller pricing, margins, commissions, and payouts

- Provisioning tied to billing: access should start and stop based on what was bought

- Finance close pressure: settlement and invoice data must match your books

If your billing work is mostly single-product, single-price, and limited to sending invoices, a lighter invoicing tool may be enough.

What AppGallop covers in a Cloud Billing setup

AppGallop treats billing as part of cloud commerce operations, not a separate finance-only tool. It helps you keep orders, entitlements, subscriptions, and support context linked so billing reflects what customers actually received.

| Need in cloud billing | What AppGallop helps you set up |

| Offer and order management | A clear path from order to active service |

| Usage and billing rules | Rules for subscriptions, usage, proration, and adjustments |

| Partner and channel flows | Pricing and margin rules across partner tiers |

| Month-end reporting | A single view of invoices, credits, and settlements |

| Support linked to billing | Tickets tied to subscription and plan details |

The practical value is simple. When order status, service status, and billing status stay aligned, fewer invoices need manual fixes later.

How does it work in practice?

Here is a simple way teams use AppGallop to keep billing aligned with service delivery:

- Define products, plans, add-ons, and pricing rules in one place

- Connect the purchase or order to provisioning so that access matches the plan

- Bring usage inputs into the billing rules for usage charges

- Generate invoices and track payments based on the same rules

- Produce finance-ready reports for collections, renewals, and settlements

What you can measure after setup

The goal is to cut manual fixes and make billing repeatable as volume grows. Common measures include:

- Fewer invoice disputes and credit notes caused by usage mismatch

- Faster private pricing approvals for large accounts and partner-led deals

- Better on-time collections through clearer invoices and payment follow-ups

- Less month-end time spent on reconciliation

AppGallop is most useful when revenue ops, service delivery, and finance need one view of what was sold, what was delivered, and what was billed.

Book a Free Demo Right Away to see the best Cloud Billing Software platform in action!

Conclusion

Cloud billing software is a revenue system, not an invoicing tool. If you are a CSP, MSP, telco, or ISV, you need billing that can handle hybrid pricing, usage rating, plan changes, partner models, and month-end reporting without manual clean-up.

Start by defining your first pricing motion, then pick a system that can expand to usage, partners, and regions. When billing, provisioning, and finance reporting match each other, your team spends less time fixing invoices and more time building predictable revenue.

FAQs

Cloud billing software manages recurring, usage-based, and one-time charges, then turns them into invoices, payments, tax records, and reporting that finance can use.

Subscription billing software focuses mainly on recurring plans. Cloud billing software is broader, it covers subscriptions, usage rating, invoicing, tax, payments, and often multi-tenant needs for CSPs and telcos.

Multi-tenant billing, partner or reseller billing rules, usage rating, proration, tax handling, and integrations with provisioning and finance systems.

When invoices are wrong, payments fail, or plan changes create confusion, customers pause renewals or cancel. Billing and payment issues often show up as involuntary churn.