More enterprise buyers want to purchase software through the cloud provider they already run on. A hyperscaler marketplace is the online store run by AWS, Azure, or Google Cloud where third-party vendors publish offers that customers can buy on their cloud bill, often using committed cloud spend.

Canalys estimates cloud marketplace sales will grow past US $45 billion by 2025. For buyers, that means fewer invoices and a purchase flow that fits cloud budgets. For vendors, it adds operational work: offer packaging, metering (if usage-based), private offers, partner margin rules, and month-end settlement that has to match the hyperscaler invoice.

If you are a vendor or a cloud partner, three questions usually show up early:

- What is included in a hyperscaler marketplace, and how is it different from a normal app marketplace?

- How do private offers and cloud commitments change pricing talks and approvals?

- What breaks after the first few deals, and what does a repeatable operating model look like?

This guide answers those questions and maps the pain points to the next steps.

Key takeaways

- Hyperscaler marketplaces work because buyers can buy on their cloud bill and apply committed spend.

- Public listings drive self-serve, while private offers drive larger enterprise deals and partner-led motions.

- Marketplace success depends on packaging, metering, billing, and deal desk operations, not just marketing.

- Partners are becoming a bigger part of marketplace transactions, especially for larger accounts.

- The fastest wins come from choosing one clear motion first, then building repeatable operations around it.

What A Hyperscaler Marketplace Is, and What It Is Not?

A hyperscaler marketplace is a commercial channel operated by a major cloud provider. Vendors publish offers that are transactable inside the hyperscaler’s billing and procurement system. Customers buy those offers as part of their cloud purchasing flow, and the charges appear on the same invoice as their infrastructure spend.

A few terms matter here:

- Hyperscaler means a cloud provider with massive infrastructure and a large enterprise customer base, such as AWS, Azure, and Google Cloud.

- Marketplace means the provider’s catalog and buying workflow for third-party software and services. Think “cloud procurement,” not just “app browsing.”

- Committed cloud spend means multi-year commitments customers sign with hyperscalers. Those commitments can often be used for approved marketplace purchases, which is a big reason buyers prefer this route. (Light Reading)

What it is not: a generic app directory. In a normal directory, browsing is the main job. In a hyperscaler marketplace, transaction rules, billing, partner margins, and procurement controls matter as much as browsing.

Why Buyers Keep Moving Purchases Into Hyperscaler Marketplaces?

Enterprise procurement has two persistent problems: time and budget routing. Traditional software buying can involve new vendor setup, legal review, payment setup, and separate invoices. Hyperscaler marketplaces shift a chunk of that work into a system the buyer already uses.

Here is what changes for the buyer:

- Budget use becomes easier:

Large customers have hundreds of billions in multi-year cloud commitments across the top hyperscalers. (Omdia) When a portion of that committed spend can be applied to third-party offers, the path to “approved budget” is shorter than starting fresh with a new vendor.

- Billing and governance are centralized:

One invoice, one purchase workflow, and procurement controls that are already in place for cloud spend. This matters most for security, infrastructure, and business software that sits close to production systems.

- Vendor risk feels lower:

Buyers often see marketplace procurement as “buying on the hyperscaler’s paper,” with existing procurement guardrails and fewer steps than onboarding a new supplier.

These shifts explain why hyperscaler marketplace sales are expected to rise from US 16 billion in 2023 to US $85 billion by 2028, according to Canalys reporting. (Light Reading)

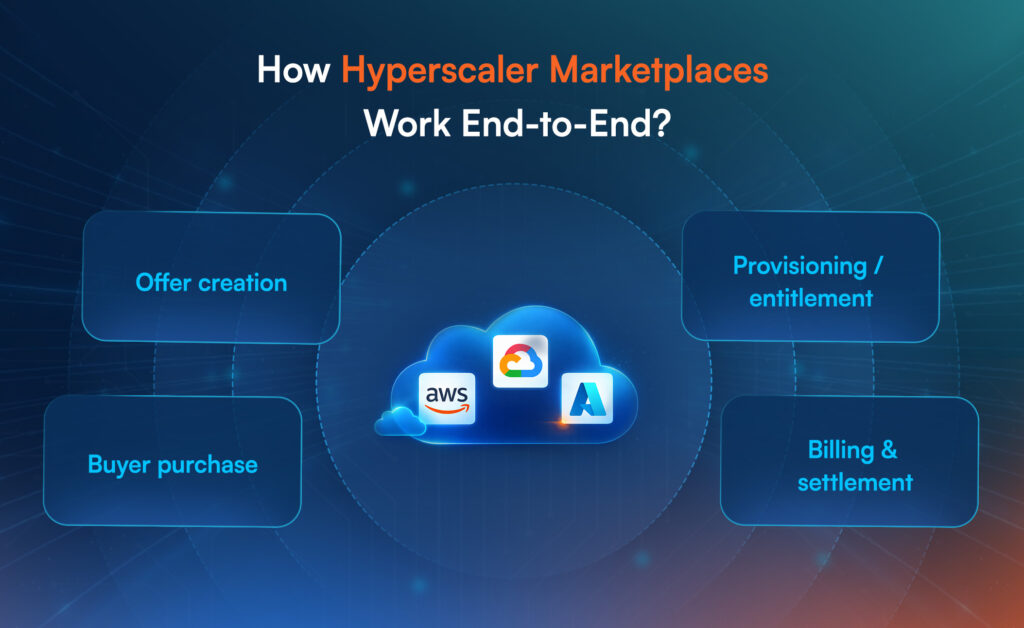

How Hyperscaler Marketplaces Work End-to-End?

Most marketplace sales follow the same backbone, even if the UI differs across AWS, Azure, and Google Cloud.

- First, the vendor creates a transactable offer. That includes packaging (SaaS, container, VM image, usage-based), pricing logic, and, in many cases, metering.

- Second, the buyer selects the offer and checks out on their cloud account. The purchase sits inside their existing governance, budgets, and approvals.

- Third, the vendor provisions access or entitlements. This step can be instant for a self-serve offer, or coordinated for an enterprise offer.

- Fourth, billing and revenue reporting follow the hyperscaler invoice and settlement model. Month-end reconciliation becomes a real operational function, not an afterthought.

The detail that surprises many teams: the marketplace “go-live” is only the start. The hard part is making the motion repeatable across deals, regions, partners, and renewal cycles.

Public Listings vs Private Offers: What Each is Good For?

Most marketplaces support two main commercial paths. You can think of them as two motions you can run in parallel, once the basics work.

| Offer type | Best for | How the buyer buys | What the vendor must get right |

| Public listing | Self-serve trials, smaller deals, standard SKUs | Direct purchase from the marketplace catalog | Product packaging, metering (if usage-based), clean onboarding, support flow |

| Private offer | Enterprise deals, custom terms, partner-led deals | Seller creates a custom offer for a specific customer | Deal desk process, approvals, quote to cash mapping, partner involvement, renewal terms |

A practical rule: public listings can build pipeline through being easy to find and trials. Private offers tend to produce larger deal sizes, more custom pricing, and more partner participation.

Sell through marketplaces without adding manual work to billing and provisioning.

Button text: See the operating model

Canalys notes marketplaces have lowered fees from above 20% down to as low as 3%, which makes multi-party deals more workable, including partner margins inside the transaction.

The Vendor Pain Points that Show Up after Your First Few Deals

Most vendors can get to a first listing with focused effort. The pain usually starts when deals scale and every team touches the motion: sales, finance, product, support, and partners.

- Packaging and metering pain

Offer packaging drift. Sales wants custom terms, product wants fewer SKUs, finance wants clear billing. Without a shared offer model, every deal becomes a one-off.

Usage measurement gaps. If usage-based billing is part of your offer, metering has to match how customers perceive value and how finance recognizes revenue. Small mismatches create disputes and write-offs later.

- Deal desk and approvals pain

Private offer turnaround time. Enterprise buyers expect fast back-and-forth. If approvals, legal terms, and pricing changes live in email threads, the cycle slows.

Cloud commitment alignment. Buyers may push to use cloud credits. That affects discounting logic and how you position value against “budget already committed.” Omdia estimates marketplace spend could rise from US $30 billion in 2024 to US $163 billion by 2030, driven in part by committed cloud spend and more planned marketplace procurement.

- Partner and channel pain

Partner attribution disputes. If a partner sourced the deal but the transaction looks “direct,” you need rules for deal registration, margin flow, and reporting.

Multi-marketplace distribution complexity. Many vendors sell on more than one hyperscaler marketplace. Each has different listing rules, settlement files, and partner constructs. The operational load adds up fast.

Omdia expects partners to facilitate nearly 60% of marketplace transactions by 2030. That makes partner-ready operations a revenue issue, not a nice-to-have.

- Billing, settlement, and revenue reporting pain

Invoice and settlement mismatch. Marketplace settlement data must tie back to your internal billing, finance, and revenue recognition. If you do not build a clear mapping early, the month-end close turns into a manual exercise.

Tax and regional rules. As you sell across regions, you face different tax handling and invoicing expectations. Marketplace models reduce some complexity, but do not remove it.

- Support and renewal pain

Provisioning handoffs. When provisioning relies on manual tickets, the buyer’s “purchase completed” moment does not match the “value started” moment. That increases refunds and churn.

Renewal timing and co-termination. Customers often have multiple subscriptions. If renewals do not align, renewals become noisy, and expansion becomes harder.

A Practical Operating Model for Marketplace Sales

Marketplace selling works best when you treat it like an operating model, not a side project. Here is a simple way to split ownership so work does not disappear between teams.

| Work area | Owner | What “done” looks like |

| Offer catalog and pricing | Product + revenue ops | Clear SKUs, pricing rules, and version control |

| Private offer process | Sales ops + deal desk | Repeatable steps, clear approvals, standard terms library |

| Provisioning and entitlement | Engineering + support ops | Order-to-activation flow with tracking and exception handling |

| Finance and reconciliation | Finance ops | Marketplace settlement ties to internal books every month |

| Partner motion | Channel team | Deal registration rules and margin visibility for partners |

| Reporting | RevOps + finance | One view of pipeline, bookings, and renewals by marketplace |

This split is simple on purpose. The main point is to prevent “marketplace work” from becoming a long tail of manual tasks in every team.

Which go-to-market motion should you start with

You can run several marketplace motions, but starting with one reduces rework.

- Self-serve listing motion: Best when your product has a short time-to-value and buyers can try it without heavy services. Your focus is onboarding, usage tracking, and support flows.

- Enterprise private offer motion: Best when deal sizes are larger and customers need custom terms. Your focus is deal desk speed, partner involvement, and clean quote-to-cash mapping.

- Partner-led motion: Best when partners bring in buyers, bundle services, or manage customer relationships. Your focus is partner pricing rules, deal registration, and clear payout logic.

If you pick the motion first, you can design offers, provisioning, billing, and reporting around that motion. If you do the reverse, you often rebuild later.

Common Mistakes Vendors Make with Hyperscaler Marketplaces

- Treating the marketplace like a marketing channel only.

Being easy to find matters, but the hard work sits in transaction design and post-sale operations.

- Copying on-site pricing without thinking about cloud budgets.

Marketplace buyers often compare your offer to “budget already committed.” The pricing story has to fit that reality.

- Ignoring partner workflows.

Even if your first sales are direct, partners often appear when you start selling into larger accounts. Canalys forecasts close to one-third of marketplace procurement will be done via channel partners by 2025.

- Letting reconciliation become a spreadsheet job.

If finance cannot reconcile marketplace settlement to internal records with a clear mapping, growth produces accounting pain.

How AppGallop Helps Vendors and Partners Run Marketplace Sales Across Hyperscalers?

AppGallop focuses on cloud commerce operations for CSPs, cloud distributors, telcos, and vendors who sell through hyperscaler programs.

AppGallop describes modules that cover marketplace, provisioning automation, lead-to-order, ticket-to-resolution, channel automation, and subscription billing. (check out our: LinkedIn)

For hyperscaler marketplace motions, the scope matters because the pain is rarely a single tool problem. You need the purchase flow, the activation flow, and the billing flow to match each other.

- Multi-cloud catalog control: keep offers aligned across AWS, Azure, and Google Cloud.

- Order-to-activation automation: connect marketplace purchases to provisioning steps.

- Quote-to-cash mapping: tie private offers to billing, invoicing, and finance close.

- Partner and channel rules: track pricing and margin logic across multi-tier networks.

- Support tied to subscriptions: link tickets and SLAs to active customer entitlements.

If you want a live demonstration of everything that AppGallop’s Budled Marketplace can offer, fill this form to Book a Free Demo Today!

Conclusion

A hyperscaler marketplace can be a strong route to market because buyers can buy on their cloud bill and apply committed spend.

But vendors only see repeatable growth when they treat marketplace selling as an operating model: clear offer packaging, fast private offer workflows, clean provisioning, and finance-grade reconciliation. Start with one motion, build the process around it, and then expand to partners and additional marketplaces once the basics run smoothly.

If you want to run hyperscaler marketplace sales without adding manual work at every step, focus on connecting catalog, billing, provisioning, and support into one flow.

FAQs

A hyperscaler marketplace is an online store run by a major cloud provider where third-party software and services can be purchased through the buyer’s cloud account. The purchase typically appears on the buyer’s cloud bill, which changes procurement and approvals.

Because it keeps purchasing inside their existing cloud procurement setup, follows their cloud budget approvals, and reduces the effort of onboarding new vendors and managing separate invoices. It also helps them align software spend with cloud commitments.

A private offer is a custom, negotiated deal created for a specific buyer account with tailored pricing and terms. It is commonly used for enterprise deals, partner-led deals, and contracts that do not fit a standard public listing.

Inconsistent offer packaging, slow private-offer turnaround, manual provisioning, settlement and reconciliation mismatches at month-end, and unclear partner attribution that leads to disputes and delays.