The subscription and usage-based economy is no longer a niche play. Global subscription revenues are projected to reach around $1.5 trillion in the next few years, growing at a double-digit CAGR as more services move to recurring models (source: PYMNTS.com).

Yet behind this growth, most finance and ops teams are still fighting spreadsheets. One recent guide on finance automation found that 56% of finance teams spend more than 10 hours every week on manual invoice processing, leading to duplicate invoices and even accidental duplicate payments (source: zoneandco.com).

In the cloud world—CSPs, MSPs, telcos and ISVs selling via hyperscaler marketplaces—this problem is multiplied by:

- Complex usage data coming from multiple clouds

- Multi-currency, multi-entity billing

- Partner revenue-share, private offers and marketplace transaction fees

Before we go deeper, ask yourself:

- Are you still reconciling usage data from multiple clouds and channels in spreadsheets every month?

- Do billing disputes with partners or enterprise customers regularly delay cash collection?

- Are you unsure exactly where revenue is leaking in your quote-to-cash process?

If the answer is “yes” to even one of these, you don’t just need “an invoicing tool.”

You need SaaS billing software designed for cloud providers and marketplaces—the kind of billing and revenue engine AppGallop is built to deliver.

Key Takeaways

- SaaS billing software automates rating, invoicing, collections and revenue recognition for subscription, usage-based and hybrid pricing models.

- Cloud providers need more than generic billing: they must support multi-tenant SaaS, multi-currency billing, partner commission automation, cloud marketplace fees and convergent billing across products, services and support.

- The right platform combines a billing mediation layer, real-time rating engine, dunning and revenue recognition automation, and quote-to-cash orchestration.

- AppGallop is built specifically for CSPs, MSPs, telcos and ISVs, helping them move from fragmented tools to a single lead-to-cash and usage-to-revenue system.

- Done well, modern SaaS billing reduces manual effort, improves revenue assurance, shortens DSO and gives finance leaders clear visibility into MRR, ARR and expansion revenue.

What Is SaaS Billing Software In A Cloud Context?

SaaS billing software is a platform that manages the full financial lifecycle for recurring and usage-based services—from usage capture and rating to invoicing, collections and revenue recognition.

For cloud providers, it must handle far more than “simple subscriptions”:

- Usage-based billing for consumption (GB, API calls, seats-per-hour etc.)

- Hybrid pricing models combining flat subscription + metered usage + overage charges

- Multi-tenant SaaS and multi-entity accounting, where one platform serves many end-customers, partners and legal entities

- Partner & channel programs, where revenue is shared, commissions are paid and margins must be tracked at each tier

- Marketplace operations, where offers are sold via hyperscaler marketplaces and billed back into the customer’s existing cloud commit

Core Jobs SaaS Billing Software Should Handle

A purpose-built system for CSPs, MSPs and telcos typically covers:

- Data mediation & normalization – ingesting call detail records (CDRs), usage logs or API metering data from multiple sources and normalizing it into a billing-ready format (a “billing mediation layer”).

- Rating and charging – applying tariffs, discounts, tiered pricing and reserved-capacity rules in a real-time rating engine.

- Subscription lifecycle management – upgrades, downgrades, co-term alignment, proration billing, contract renewals and add-ons.

- Invoicing & taxation – generating accurate invoices with local tax rules (VAT/GST, sales tax automation) across multiple geographies.

- Collections and dunning management – retry logic, dunning campaigns and workflows for failed payments and overdue accounts.

- Revenue recognition automation – ASC 606 / IFRS 15-compliant allocation and scheduling of recurring and usage revenue.

- Analytics & revenue assurance – dashboards for MRR, ARR, churn, expansion revenue and revenue leakage detection.

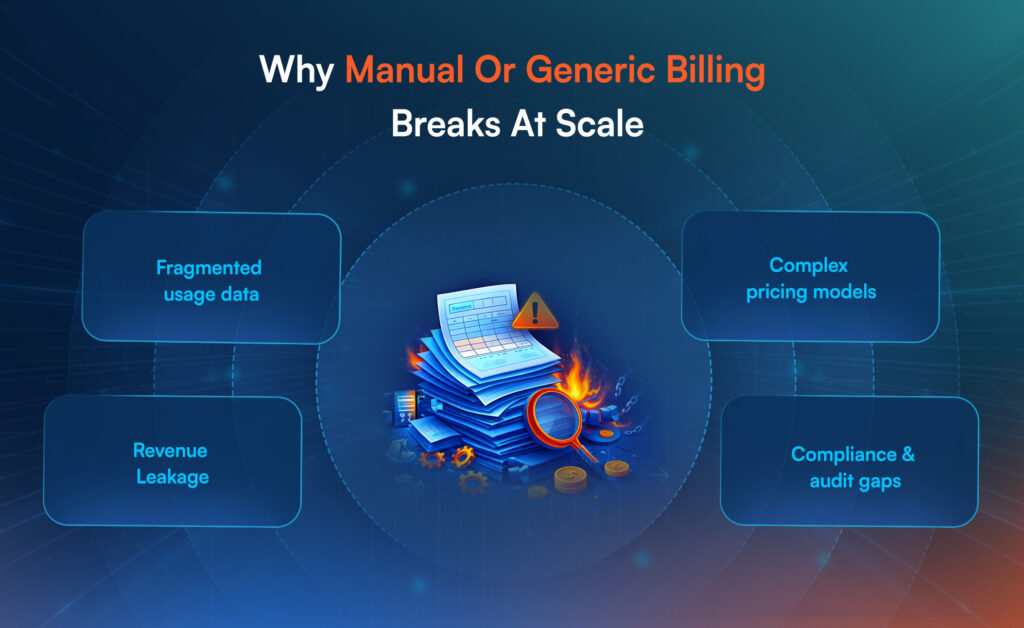

Why Manual Or Generic Billing Breaks At Scale

Fragmented Data Across Clouds And Channels

Cloud businesses rarely sell one simple SKU. They sell:

- IaaS, PaaS and SaaS combinations

- First-party and third-party services

- Bundled offerings across multiple clouds and vendors

Without a mediation system, each of these generates usage data in different formats. Manual consolidation quickly becomes error-prone, delaying invoices and obscuring true profitability per product, partner or customer segment.

Complex Pricing Models And Commitments

CSPs and MSPs increasingly rely on:

- Consumption-based pricing

- Committed-use discounts and reserved capacity

- Good-better-best subscription tiers with overage charges

Spreadsheets struggle with tiered pricing, co-term alignments and mid-cycle contract changes. A small mistake in formulas can ripple into thousands of under- or over-billed dollars.

Revenue Leakage And Compliance Risk

Finance leaders often discover revenue leakage months later—through reconciliation issues, audit findings or customer disputes.

Common sources include:

- Missed billable usage from certain data feeds

- Incorrect proration or discount application

- Duplicate or missed invoices

- Poorly tracked credit memos and adjustments

With manual processes, it’s hard to maintain a complete audit trail or meet revenue recognition standards like ASC 606 and IFRS 15, especially when dealing with multi-year enterprise contracts and multi-element arrangements.

Key Capabilities To Look For In SaaS Billing Software For CSPs, MSPs And Telcos

When evaluating a billing platform for cloud distribution and marketplaces, focus on capabilities that map to your real-world complexity.

1. Strong Mediation Layer For Usage Data

- Collects data from multiple clouds, network elements and SaaS platforms

- Normalizes different file formats into a consistent schema

- Filters out non-billable events and aggregates partial records

- Feeds clean data into rating, analytics and fraud-management systems

This is the heart of any telecom mediation or cloud usage pipeline.

2. Flexible Rating And Charging Engine

Look for support for:

- Usage-based, tiered and hybrid pricing models

- Spot pricing and reserved-capacity pricing

- Add-ons, bundles and cross-product discounts

- Zero-rated transactions and promotional credits

A powerful rating engine lets product teams innovate on pricing without creating chaos for finance.

3. Convergent Billing And Multi-Entity Support

Cloud providers often need convergent billing—a single invoice that combines:

- Cloud infrastructure

- SaaS licenses

- Professional services

- Support and managed services

The platform should support multi-currency billing, multi-entity accounting and billing hierarchy management (parent-child accounts, reseller vs. end-customer relationships).

4. Partner & Channel Revenue Management

For CSPs, MSPs and distributors, partner ecosystems are central:

- Partner commission automation and channel margin management

- Two-tier distribution models (vendor → distributor → reseller)

- Deal registration, partner performance scorecards and partner credit limits

- Automated back-to-back ordering and inventory-less billing models

These capabilities turn the billing system into a true partner & channel management hub.

5. Compliance, Taxation And Revenue Assurance

You’ll want:

- ASC 606 / IFRS 15-aligned revenue recognition automation

- VAT/GST management and sales tax automation across markets

- Audit trail maintenance and revenue leakage detection

- Integration with your GL and data lake for downstream analytics

6. API-First Architecture And Integration

An API-first architecture, webhooks and iPaaS-friendly integrations make it possible to:

- Connect CRM, CPQ, ERP and customer portals

- Trigger event-driven billing (e.g., on provisioning or entitlement changes)

- Support headless commerce experiences for partners and customers

How AppGallop Powers SaaS Billing For Cloud Providers

AppGallop is designed as a cloud commerce and billing engine for CSPs, MSPs, telcos and ISVs building on hyperscaler and private marketplaces.

Instead of stitching together multiple tools, AppGallop gives you:

A Unified Lead-To-Cash And Usage-To-Revenue Flow

- Cloud catalog management for products, bundles and private offers

- Quote-to-cash (Q2C) workflows from opportunity and quote through order, provisioning and billing

- Billing mediation for usage data across clouds and services

- Rating and charging for subscription, usage and hybrid pricing models

- Automated invoicing, dunning and revenue recognition

Channel And Marketplace-Ready Billing

- Partner portal management so resellers and distributors can self-serve offers, quotes and orders

- Partner commission automation and channel margin management for multi-tier distribution

- Support for white-label marketplaces where partners resell under their own brand

- Entitlement management and instant provisioning for subscription and usage services

Revenue Assurance And Financial Operations

- Multi-currency, multi-entity billing with taxation support

- Reconciliation automation between billing, payments and bank statements

- Revenue leakage detection and audit-ready trails

- Dashboards for MRR, ARR, ARPU and expansion revenue tracking

In short, AppGallop becomes the central billing and revenue operations layer that connects your catalog, commerce, provisioning and finance stack.

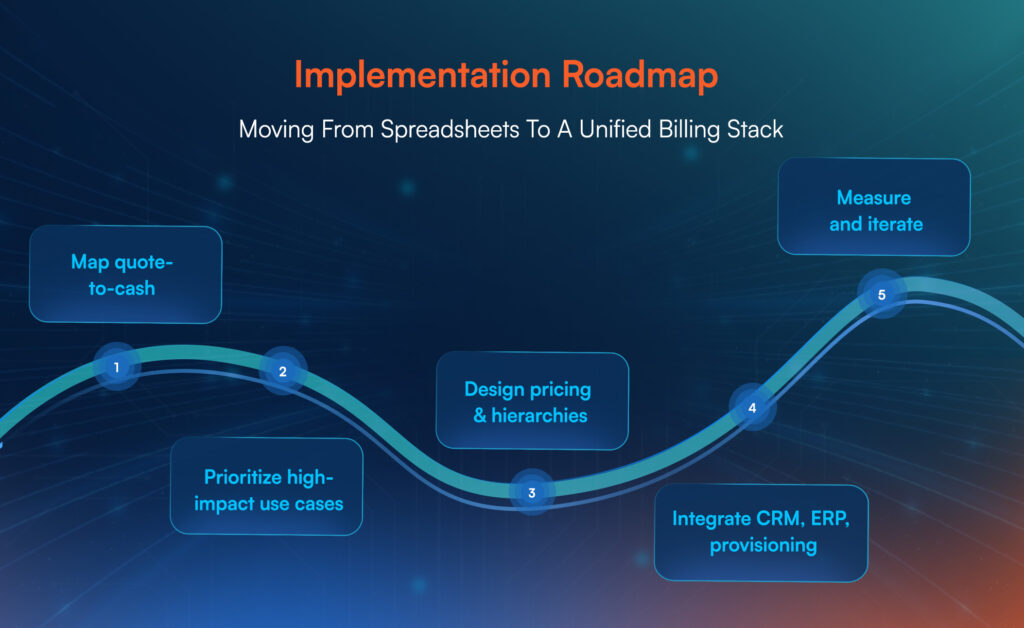

Implementation Roadmap: Moving From Spreadsheets To A Unified Billing Stack

1. Map Your Current Quote-To-Cash Flow

Document:

- How leads become quotes, orders and contracts

- Where usage data originates and how it is processed

- How invoices are generated, approved and sent

- How payments, refunds and credit notes are handled

This gives you a baseline to identify bottlenecks and revenue leakage.

2. Prioritize High-Impact Use Cases

Start with:

- One or two key product lines (e.g., your main cloud bundles)

- High-value partner programs or marketplaces

- Regions with complex tax or currency requirements

Don’t try to migrate everything at once; focus on areas where automation gives the fastest ROI.

3. Design Your Pricing And Account Hierarchies

Work with product, sales and finance to:

- Define standard offers, bundles and “good-better-best” tiers

- Decide on account hierarchies (parent vs. child, reseller vs. end-customer)

- Align pricing and discount strategies with your long-term land-and-expand motion

4. Integrate With CRM, ERP And Provisioning

Ensure the billing platform is tightly connected with:

- CRM/CPQ for quotes and contract data

- Provisioning and service orchestration systems for activation and entitlements

- ERP/GL for revenue recognition and accounting

This is where AppGallop’s API-first architecture and integration patterns become critical.

5. Roll Out, Measure And Iterate

Once live:

- Track metrics like DSO, billing accuracy, involuntary churn (failed payments) and time-to-invoice

- Monitor the percentage of automated vs. manual interventions in billing workflows

- Use insights from usage analytics and expansion revenue tracking to refine pricing and packaging

Conclusion

SaaS billing software is no longer a nice-to-have add-on for cloud providers. For CSPs, MSPs, telcos and ISVs, it is the core system that turns raw usage, contracts, and partner deals into predictable revenue.

With a strong mediation layer, flexible rating engine, partner and marketplace billing, and compliant revenue recognition, finance and ops teams can finally trust that every unit of consumption is billed correctly and on time. Sales teams can shape creative offers without worrying about downstream chaos. Leadership gets clear visibility into MRR, ARR, churn, and expansion revenue so they can plan growth with data, not guesswork.

FAQs

SaaS billing software is a platform that automates how recurring and usage-based services are priced, invoiced, collected and recognized as revenue. It replaces spreadsheets and disconnected tools with a single system that handles subscriptions, metered usage, taxes, discounts and revenue schedules.

Basic invoicing or ERP tools generate invoices, but they are not built for complex subscription and usage models. SaaS billing platforms support proration, co-terming, dunning, revenue recognition rules and multi-tenant account structures that standard accounting systems usually can’t handle without heavy customization.

Any CSP, MSP, telco or ISV that sells recurring or usage-based services at scale should consider specialized SaaS billing. If you manage thousands of subscriptions, multi-cloud usage, partner commissions or marketplace sales, a generic billing tool will eventually cap your growth and increase revenue leakage risk.

Key metrics include billing accuracy, Days Sales Outstanding (DSO), MRR/ARR growth, involuntary churn from failed payments, and the percentage of revenue recognized automatically. Improvements across these indicators show whether your new billing stack is actually reducing leakage and accelerating cash conversion.